Hello, Truckers! The next season for this year is right around the corner, and you should report form 2290 HVUT to the IRS once the tax season begins in July 2022. You must pay the tax dues in full for the entire tax season, TY 2022-2023, and get the schedule 1 copy within August 31, 2022, to smoothly continue your trucking operations on the public highways. But the catch is IRS will get very crowded during the beginning of the tax season in July because all the truckers and trucking taxpayers are reporting their form 2290 for the tax period. IRS made form 2290 e-filing mandatory for all truckers with 25 or more vehicles in their fleet. Form 2290 e-filing is a simple, effective, and complete automatic process which takes less turnout time than the conventional paper filing method. Even the online filing method will consume some time at the beginning of tax season because IRS will process the online tax reports and approve them for schedule 1 copies for all the tax returns. Continue reading Pre-file Form 2290 for the upcoming tax season, TY 2022-2023, now!

Continue reading Pre-file Form 2290 for the upcoming tax season, TY 2022-2023, now!

Category Archives: Tax 2290 Discounts

Honoring All The Great Fathers This Father’s Day!

Celebrate Father’s Day with 10% OFF by Pre-filing Form 2290 for TY 2021-2022. Use code: THANKSDAD

A son’s first hero, a daughter’s first love. We get it! It’s hard to put into words just how special that man really means to you. Whether it’s your dad, uncle, brother or grandpa, anyone who has been a father like figure and guided you onto greener pastures deserves recognition. What better way to make sure you express your love and gratitude for him the right way this Father’s Day.

Continue reading Honoring All The Great Fathers This Father’s Day!Form 2290 renewal time for the tax year July 2020 – June 2021.

During this unprecedented crisis, while families and employees are staying safe home, the trucking industry is there to ensure the most critical goods are delivered to U.S. communities. Truckers making it possible to deliver essentials across the country knowing that they are getting exposed. The nation’s 3 million truck drivers are unsung heroes of the coronavirus crisis, working overtime to keep the critical supply chain moving. We salute them for the Selfless Service and helping all the Front Liners equipped with essentials. Let this July be a new beginning for us to move forward from crisis to recovery.

This July we’re celebrating our independence and we wish every one a Happy 4th of July. It is also the time of the year, the federal vehicle use tax form 2290 for this new tax year July 2020 through June 2021 is up for renewal. The Form 2290 and Schedule 1 has to be reported and get it stamped to show that as a proof of payment to have the vehicles registered under your authority with the federal agencies.

Continue reading Form 2290 renewal time for the tax year July 2020 – June 2021.Prefile Form 2290 for the Tax Year 2020 at a Discounted Price!

This is the same time of the year to report or renew your Form 2290 heavy motor vehicle use tax with the IRS and to receive the stamped Schedule -1 proof. Because you need to renew and register your vehicles with the states authorities. This year we’re going through tough time fighting the pandemic and thanks to the Truckers who still on the wheels when the world is staying at home. We’re with you and we wish everything come to an end and the industry recovers faster than before. Let us all fight it together as an unit.

Prefile 2290 for July 2020 – June 2021 Tax Period

Why you wait till July or August to report your Heavy Vehicle Use Tax Form 2290 for Tax year 2020 – 2021, we at TaxExcise.com made it simple and prefiling 2290 is now available exclusively at a discount of 10% from the e-file service fee.

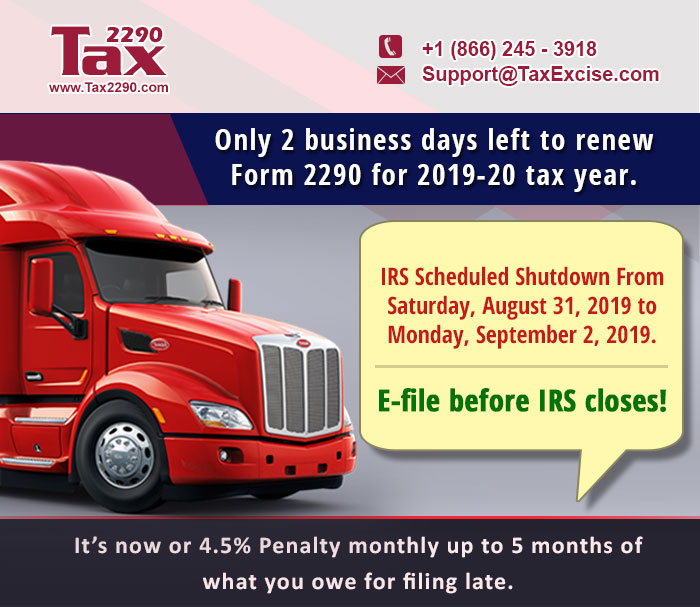

Continue reading Prefile Form 2290 for the Tax Year 2020 at a Discounted Price!HEADING TOWARDS LAST COUPLE OF DAY TO RENEW FORM 2290 WITH THE IRS FOR THE TAX YEAR JULY 2019 TO JUNE 2020

We are heading towards the end of August and the official deadline for IRS Tax Form 2290 is extended till September 3, 2019 for this tax year as the usual due date August 31 falls on a Saturday. The next business day, September 2 is a Federal Holiday so the official deadline is September 3, 2019.

Today August 29th and you have just couple of days to get your Federal Vehicle Use Tax Form 2290 renewed and receive back the Watermarked Schedule 1 Proof of Payment for this current tax year.

IRS Tax Form 2290 and Watermarked Schedule 1 receipt.

This Form 2290 is an annual tax paid in advance with the IRS for all the heavy vehicles use on a public highway from July and that is to be registered on your name with the federal bodies such us DOT and DMV.