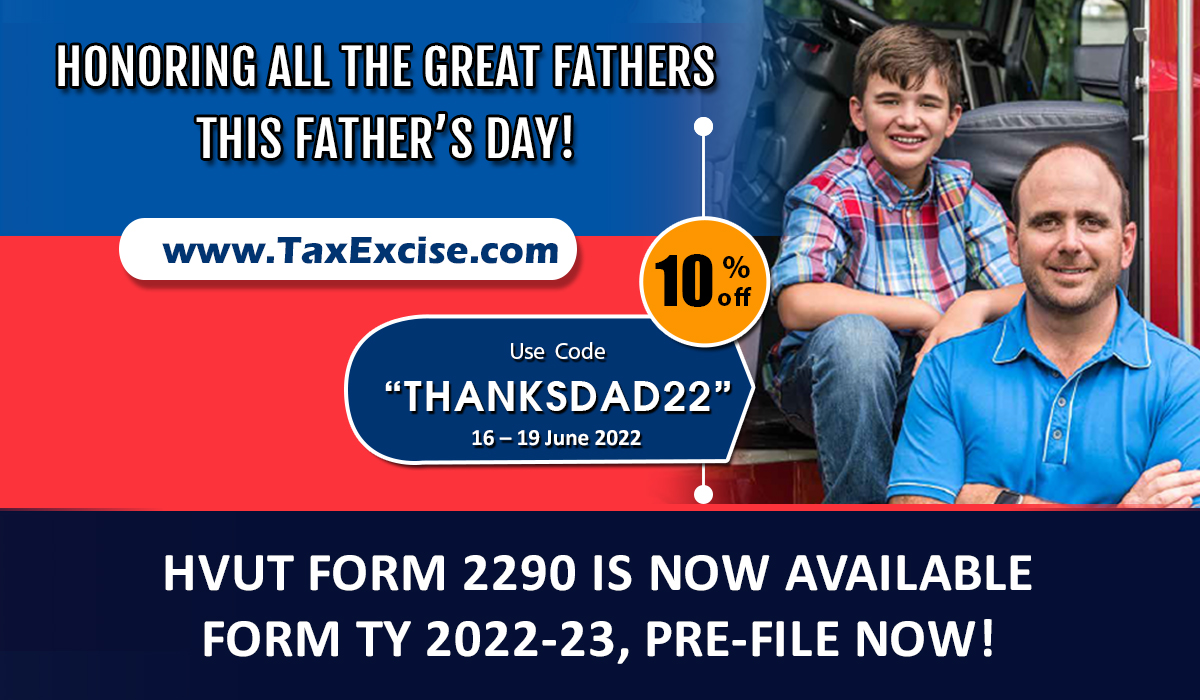

Hello, Truckers! Trucking is one of the biggest businesses in America; truckers are practically risking everything to move everything around the country from place to place. We should appreciate all the wonderful truckers out there and celebrate their contributions to our society. Many truckers spend so much time away from their families to provide this timely trucking service, and we at TaxExcise.com want to honor their service in the event of Father’s Day. Therefore, we are giving out a special discount on form 2290 pre-filing for the upcoming tax year. Form 2290 pre-filing for the next tax season, TY 2022-2023, is actively happening on TaxExcise.com. So, use this opportunity and pre-file form 2290 online at TaxExcise.com. Continue reading Let’s celebrate this Father’s Day with a special discount for your form 2290 pre-filing!

Continue reading Let’s celebrate this Father’s Day with a special discount for your form 2290 pre-filing!

Tag Archives: prefile 2290

Pre-file Form 2290 for the upcoming tax season, TY 2022-2023, now!

Hello, Truckers! The next season for this year is right around the corner, and you should report form 2290 HVUT to the IRS once the tax season begins in July 2022. You must pay the tax dues in full for the entire tax season, TY 2022-2023, and get the schedule 1 copy within August 31, 2022, to smoothly continue your trucking operations on the public highways. But the catch is IRS will get very crowded during the beginning of the tax season in July because all the truckers and trucking taxpayers are reporting their form 2290 for the tax period. IRS made form 2290 e-filing mandatory for all truckers with 25 or more vehicles in their fleet. Form 2290 e-filing is a simple, effective, and complete automatic process which takes less turnout time than the conventional paper filing method. Even the online filing method will consume some time at the beginning of tax season because IRS will process the online tax reports and approve them for schedule 1 copies for all the tax returns. Continue reading Pre-file Form 2290 for the upcoming tax season, TY 2022-2023, now!

Continue reading Pre-file Form 2290 for the upcoming tax season, TY 2022-2023, now!

Treat Yourself 10% flat off on your 2290 prefiling

Time is on for Truckers to start preparing the Federal Vehicle Use Tax returns for the new tax year, July 2019 to June 2020.

Pre File 2019 – 20 Form 2290 Tax returns at a Special Discounted Price! Apply Code “EARLYBIRD” to treat yourself the special discount for prefiling 2290 truck tax returns!

Howdy fellas! TaxExcise.com & Tax2290 has good news for you all waiting to file form 2290 tax returns online for 2019-20 tax year. You can now pre-file your returns online only at TaxExcise.com.

Being pioneer in the world of e-filing, we have put great effort in making this possible for you. So you can submit your form 2290 tax returns electronically for 2019-20 even before the tax year officially begins. At a flat 10% discount on our e-file preparation fee with the coupon code “EARLYBIRD”, valid till 30th June. HURRY!

What Happens When You PRE-FILE @TaxExcise.com?

Our motto behind the pre-file is to offer you an easy renewal process of your schedule-1 copy for the new tax year since, IRS e-file servers would likely be snail-slow during season time due to the e-file traffic they receive. So the sooner you e-file at TaxExcise.com, the faster you get your Schedule-1 copy stamped! It is true that IRS wouldn’t accept any 2019-20 tax returns until first week of July 2019.

However TaxExcise.com would hold your tax returns filed through us and securely submit them to the IRS the moment they open for 2019-20, and deliver your schedule-1 copy to your e-mail address instantly.

Do note, the IRS would remain closed on the below mentioned days and would process the returns on the next business day:

- July 4th Thursday – Independence Day (Federal holiday)

- Saturday & Sunday

Be the early bird and e-file your form 2290 tax returns today. TaxExcise.com recommends all truckers to e-file their returns online at the earliest in order to stay on safer grounds.

Call us at 1-866-245-3918 or mail us at support@TaxExcise.com for any suggestion and queries. Rest assured, our Tax Experts would never let you go wrong!

2290 prefiling is now available with TaxExcise

TaxExcise is now ready and offering pre-filing for Form 2290, the Federal Heavy Vehicle Use Tax (HVUT). Not only that, we are also offering 2290 filing with 10% FLAT discount for the 2018-19 tax year ahead of schedule. Exclusively for you! beat the queue and stay blessed.

Pre-File 2290 returns for 2018 – 2019 Tax Season

We offer you an easy renewal process of your schedule-1 copy for the new tax year 2018- 19, since IRS e-file servers would likely be snail-slow during season time due to the e-file traffic they receive. So the sooner you e-file at TaxExcise.com, the faster you get your Schedule-1 copy stamped! It is true that IRS wouldn’t accept any 2018-19 tax returns until first week of July 2018. Continue reading 2290 prefiling is now available with TaxExcise

Hot Summer Deal, 15% off on your 2290 Tax Prefile Return!

Summer has officially begun, and temperatures around the country are already beginning to soar. A lot of attention is required in summer while driving your big rigs. The summer months can be a dangerous time for both the driver and the truck, so it’s important to take heed of these tips for driving in summer.

“Sand And Sun, Summer Has Begun”

Someone quoted “Life Without Love Is Like A Year Without Summer”, This is Summer and will be Hot, Hot, Hot!!! We’re coming out with a Hot Deal Too. One reason to cheer…. Apply code “HISUMMER16” and avail flat 15% off from your e-file fee, valid till 26th June.

Prefile IRS HVUT Form 2290 NOW! It’s Time to Renew Form 2290 and Schedule -1 copy for the new tax year beginning July 2016. You can now PREFILE and collect your stamped Schedule -1 proof by 1st week of July when IRS completes processing your 2290 returns.

Prefiling is filing IRS Truck Tax Form 2290 returns earlier with us and we’ll get it processed with the IRS once they are back and operations. Prefile is just filing and pay your taxes only in July. You can be a 1st to claim your Form 2290 and Schedule 1 with the IRS once they start accepting returns for TY 2016. Another reason is to avail this Summer Offer, 15% off on your E-file Fee. Continue reading Hot Summer Deal, 15% off on your 2290 Tax Prefile Return!