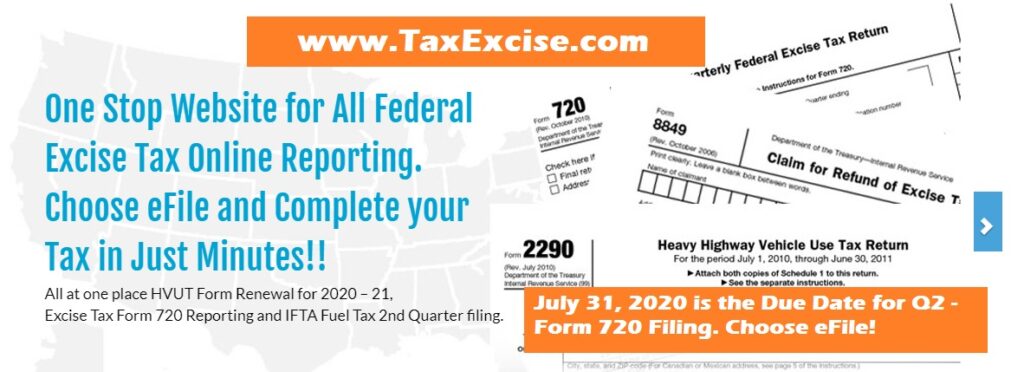

Time for Excise Taxpayers to go in full swing and complete the Quarterly Federal Excise Tax returns for the 2nd Quarter of 2020. Excise taxes collect along with the goods or services offer has to be consolidated and reported to the IRS in the tax form 720. PCORI fee is also due and has to be reported along with the 2nd Quarter of Form 720.

Form 720 – Electronic Filing – July 31 Due Date

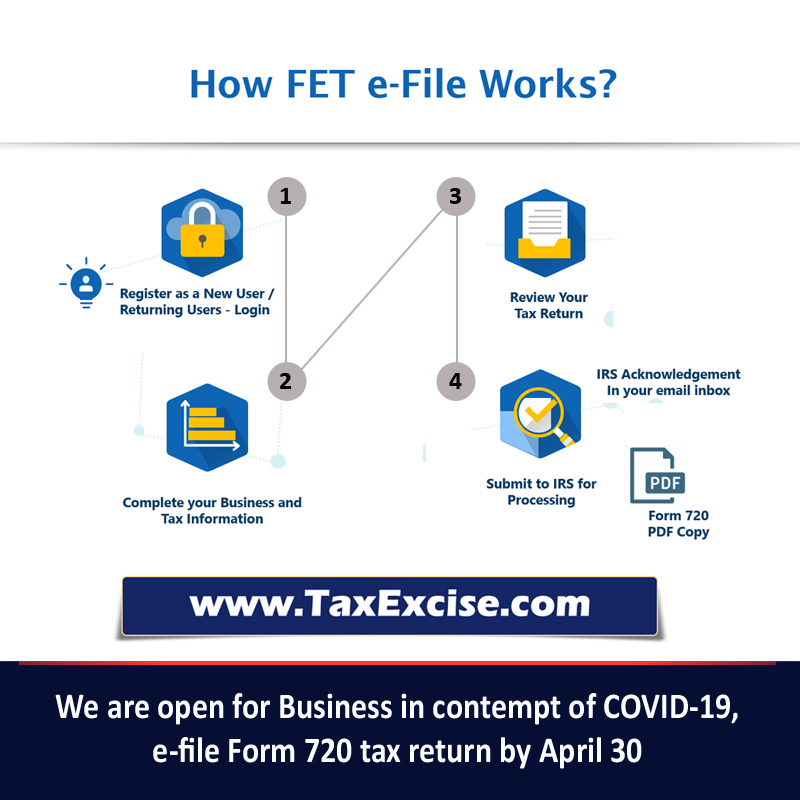

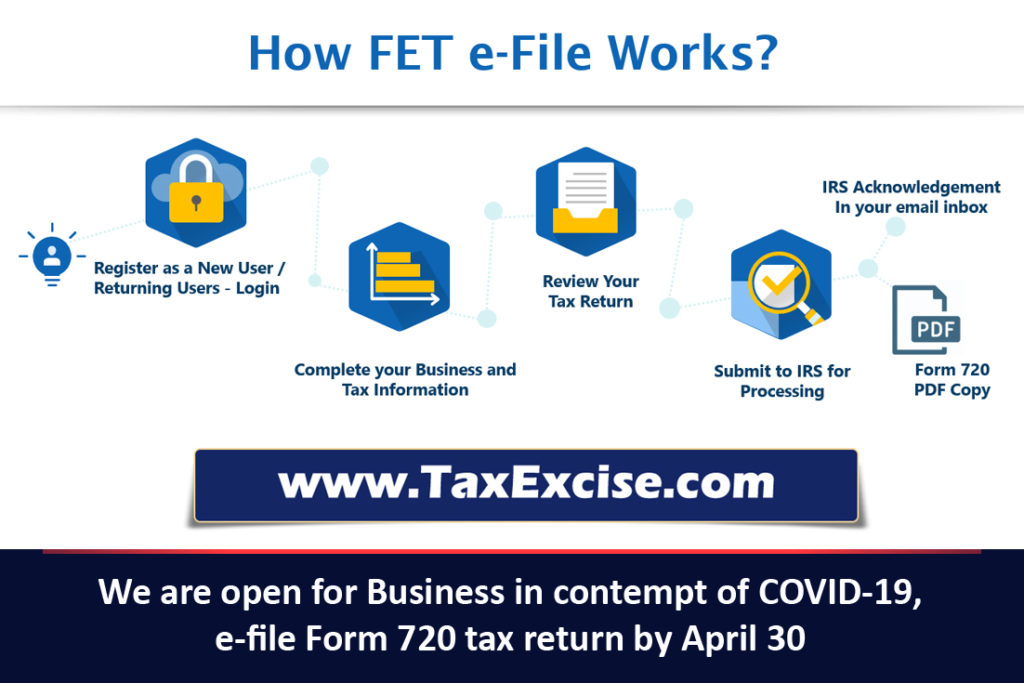

TaxExcise.com electronic filing enables you to meet excise tax compliance effortlessly with its features, error free filing is very much possible. with eFiling. For small businesses electronic filing is much handy then working with a tax accountant. Excise taxes can be prepared and reported by yourself in 3 simple steps. Just complete the information that is probed and you’re done in few minutes. Get tax calculated right, as we update the tax rates regularly when there is a new update from the IRS.

Electronic filing saves time and get it done with the help of our tax experts waiting to answer and help you through the efiling process. It won’t take much time for you to have your Federal Excise Tax returns processed by the IRS and to receive the acknowledgement in mail. The earlier you efile you get more time to work with your return if it requires an amendment or resubmission in case of rejections.

PCORI Fee in Form 720 – July 31 Due Date

New research trust fund fees are due July 31 from health insurers and the plan sponsors of self-insured plans. The fee is paid annually using Form 720, Quarterly Federal Excise Tax Return. The payment can also be paid through the Electronic Federal Tax Payment System (EFTPS) if you already have an account established.

The PCORI fee initially applied to specified health insurance policies and applicable self-insured health plans with policy or plan years ending after September 30, 2012, and before October 1, 2019; however, in December 2019 the fee was extended for an additional 10 years under the Further Consolidated Appropriations Act, 2020 (H.R. 1865) and now applies through plan years ending before October 1, 2029.

The IRS provides self-insured employers with transition relief for calculating the average number of plan enrollees, which the IRS refers to as covered lives—employees, spouses and dependents covered by the health plan. Payment due on any given July 31 covers the plan year that ended in the preceding calendar year, so the fee payable by July 31, 2020, is for plan years ending in 2019.

Electronic filing with TaxExcise.com

The due date is around the corner and you have limited time to do a paper return. Electronic filing can be strategically the best way to report and pay the Federal Excise Taxes with the IRS. Taxpayers should file on time, even if they can’t pay the full amount due. Then, they should pay the rest as soon as they can. Remember, the sooner paid, the less owed. The Internal Revenue Service reminds taxpayers about the importance of timely filing and paying their taxes, and that there are several options available to help people having trouble paying.

TaxExcise.com is an IRS authorized eFile service provider and help you to complete this Excise Tax returns electronically. The only website to efile the tax form 720, no need to have any software or tools to download, just plug into an internet connect and start efiling with TaxExcise. Talk to us today at (866) 245 – 3918 or write to us at support@taxexcise.com.