www.Tax2290.com & www.TaxExcise.com – Products of ThinkTrade Inc. wishes you all a happy and fulfilled Halloween. ThinkTrade Inc. Never fails to treat every single law Abiding Tax payer who uses its line of products to report or E-file their Taxes. Today is the Deadline to prepare and File three tax forms that can be easily done through www.Tax2290.com & www.TaxExcise.com .

www.Tax2290.com & www.TaxExcise.com – Products of ThinkTrade Inc. wishes you all a happy and fulfilled Halloween. ThinkTrade Inc. Never fails to treat every single law Abiding Tax payer who uses its line of products to report or E-file their Taxes. Today is the Deadline to prepare and File three tax forms that can be easily done through www.Tax2290.com & www.TaxExcise.com .

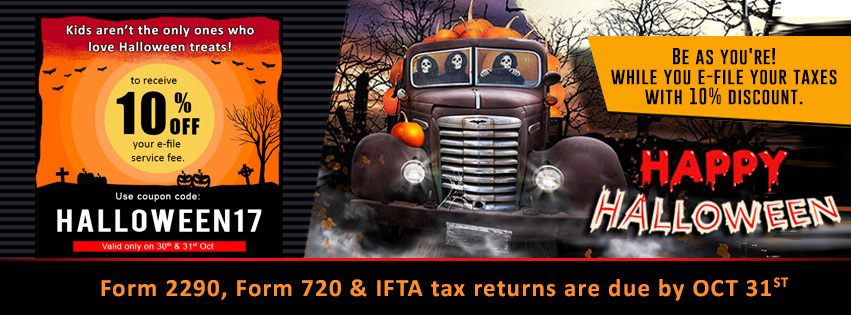

Less than 24 hours left to prepare and report or E-file three tax forms through application hosted by ThinkTrade Inc. There are thousands of tax payers who will use our application to report and e-file these tax forms today. Since Its Halloween we have decided to treat every tax payer who files his/her tax Form through us today. An Unbelievable Flat 10% OFF on the E-file Preparation fee VALID ONLY TILL MIDNIGHT TODAY. Use promo Code “HALLOWEEN17” to Avail this Amazing Offer.

Taxes that are due today: Continue reading Last Day to file your Taxes & Last day to redeem your Halloween Discount!

With just Three Official Working days remaining in October, we have three tax deadlines to meet by 31st October 2017. Halloween day comes with Scary pranks and spooky costumes, but this is neither a Halloween Prank nor the IRS wears Spooky costumes.

With just Three Official Working days remaining in October, we have three tax deadlines to meet by 31st October 2017. Halloween day comes with Scary pranks and spooky costumes, but this is neither a Halloween Prank nor the IRS wears Spooky costumes.

When you have

When you have