Electronic filing helps the Federal Vehicle Use Tax Form 2290 filers to report and pay the 2290 Truck Taxes faster, easier and more accurately than with traditional paper forms. We offer full featured online web based tax software, a self-serviced website to prepare the 2290 tax returns and pay electronically. The IRS encourages every truck taxpayer to choose electronic filing for the convenience and faster processing of tax returns, the IRS watermarked Schedule 1 Proof of Payment will be sent to them instantly once it is accepted. Correcting the errors on a rejected return is also easy, and the turn around time of processing is faster and the updated Schedule 1 is sent to the inbox directly. No delays, accurate tax math, on-time filing and filing at your comfort, no need to walk-in to a local IRS taxpayer assistance center booking appointments. Do it online from wherever you’re at anytime, 24X7 a day and 7 days a week.

Continue reading Electronic Filing is the Most Preferred Medium to Report and Pay 2290 HVUT Returns with the IRSTag Archives: Form 2290 efile

TaxExcise.com User Friendly Features For Electronic Filing

TaxExcise.com is the product of Thinktrade Inc, the first IRS authorized E-file service provider serving the Federal Excise Tax filers since 2007. Partnering with thousands of excise taxpayers, truck taxpayers and tax accountants or paid preparers to ease the federal excise tax electronic filing process. With combined efforts of tax experts and technology, we have mastered the art of filing taxes and provided ideal solutions to everyone ranging from owner operators to fleet owners, truckers and CPAs.

With a wave of services and e-filing taxes for various forms, we top the ranking in serving you right from the time you entered our website, till you exit with your acknowledged receipt. TaxExcise.com bring you the comfort of electronic filing to your home/office computer, e-file federal excise tax returns anytime from anywhere. Market leader in Excise Tax segment and only website to support all the Federal Excise Tax Forms Electronic filing at one place. Download our free mobile apps to e-file on the go. Not only that the best is yet to come…

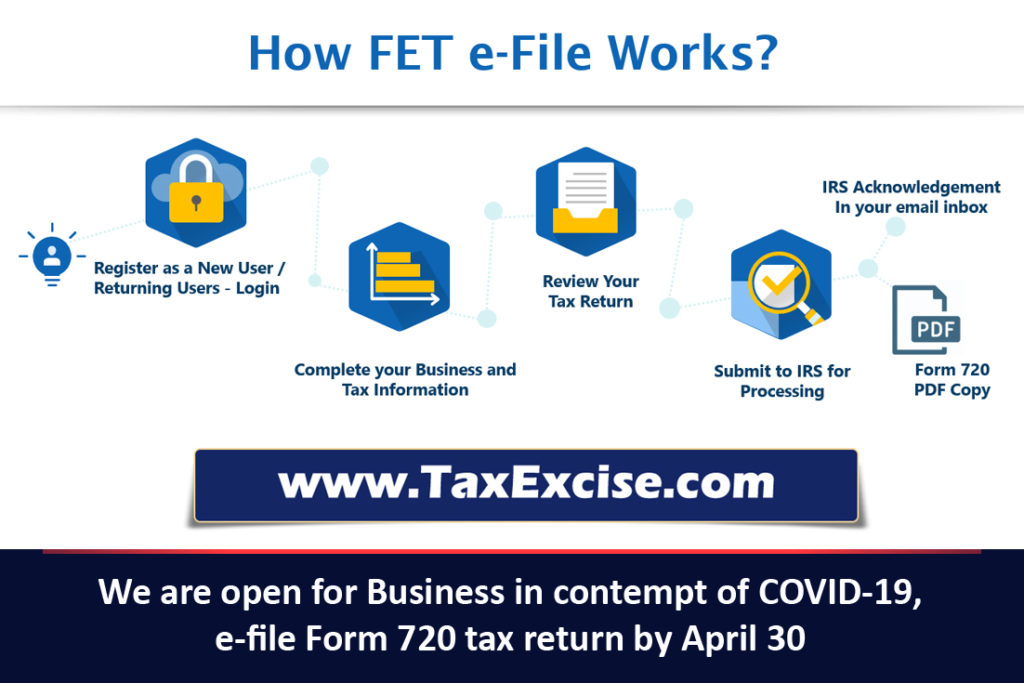

Continue reading TaxExcise.com User Friendly Features For Electronic FilingGet your Form 720 tax reported quickly through our e-filing during the COVID-19 pandemic. Due April 30 for Q1, 2020.

We at TaxExcise at this time of a global crisis do understand your needs, and wouldn’t want you to miss out on the upcoming deadlines. The clock is ticking, as businesses are closed your work is piling up, that strict timeline is looming over your head and it’s seemingly more and more unlikely that you will meet the deadline. Even though the deadline for a considerable number of forms and payments have been postponed, there are still a handful of tax forms that have not been extended by the IRS and Form 2290, Form 720 and IFTA are namely a few.

Form720 is filed every quarter to report taxes imposed on the manufacture, sale or use of certain type of goods and products, the deadline to have this reported for the 1st quarter of 2020 is April 30.

Due to the current situation with the lockdown still in effect, the most common question we had come across is “Do we still need to file form 720 if we do not have any excise tax to report?“

The answer is “Yes”, though you have not made any sale that includes Excise tax you will still need to file form 720 by reporting a Zero Return (Zero Tax Liability).

Form2290 needs no introduction, as most truckers are already aware that this form needs to be completed when a vehicle is first used or placed into service during a tax year. The April 30th deadline is for trucks that started operations and were first used anytime during the month of March.

Preparing your IFTA tax report is fast, easy and more convenient when done online. Prepare your report for the First Quarter of 2020 before the April 30th deadline.

This April deadline happens to be the one that always stands out as it revolves around 3 tax forms that serve a different purpose. You can always depend on our E-file services that is currently open and processing returns online. Though the IRS offices are not operational, their E-file services are online and tax returns are currently being processed with a turn-around time of a few minutes.

Due to the COVID-19 Outbreak we at www.TaxExcise.com have initiated a contingency and business continuity plan to ensure that all our resources are at your assistance. If you have any questions or need any help in completing federal tax returns feel free to call our Help Desk @ 866-245-3918 or email us at support@taxexcise.com do also try out our Live Chat option available on the website. We’re available on all Business days between 9:00 am to 6:00pm Central Time.

Stay Safe, Stay Strong, we are in this together.

July 1 and Form 2290 is now due for renewal

We’re so excited to celebrate our Independence day on July 4th, It’s when we celebrate our nation’s mythology with a day off, a backyard barbecue, and plenty of fireworks. We’re on for the celebrations and time for us to give it back to the #Truckers out there in road, who is making these celebrations possible with a Flat 10% off on the 2290 efile preparation fee. Teat yourself by applying the code “FREEDOM”, valid till 7th July.

July 4th holiday travel

A record-breaking number of Americans, 48.9 million, are expected to travel for Independence Day in 2019, including a record of 41.4 million people who will drive for their holiday getaways, AAA reports. A planned travel itinerary could give you more time with loved ones instead of stuck in traffic.

Overall travel volume for the holiday is expected to rise 4.1% over last year, with an additional 1.9 million people planning road trips and other vacations to celebrate America’s birthday. July 3 is expected to be the busiest day for people hitting the road, according to INRIX, a global mobility analytics company. The greatest coverage and intensity of thunderstorms is expected between 3 and 9 p.m. across this swath of the central United States; however, there could be storms before and after that time frame.

Independence Day holiday travel, by mode

- Automobiles: The vast majority of travelers – 41.4 million – will hit the road, the most on record for the holiday and 4.3% more than last year.

- Planes: 3.96 million people will take to the skies, the highest number on record and 5.3% more than last year.

- Trains, Buses and Cruise Ships: Travel across these sectors will increase by 0.6% to 3.55 million passengers.

Be prepared and plan your holidays accordingly, wish you a happy 4th of July and Independence day to the truckers out on the road. Never miss another opportunity to save during this holiday week. Happy and Safe Trucking to all…!

2016’s Taxes that are due by January 2017!

www.Taxexcise.com – a product of Think Trade Inc wishes you all a very Happy New Year. A fresh new year is once again upon us. It’s the time to be thankful for the blessings of the past year and to take stock of all our achievements. At the same time, New Year 2017 is a brand new year to start afresh, to start strong, and yet another chance to do everything we want to do this year.

www.Taxexcise.com – a product of Think Trade Inc wishes you all a very Happy New Year. A fresh new year is once again upon us. It’s the time to be thankful for the blessings of the past year and to take stock of all our achievements. At the same time, New Year 2017 is a brand new year to start afresh, to start strong, and yet another chance to do everything we want to do this year.

Hope you all had a great holiday season; it’s now time to get back to business & take care of the last obligations of 2016. Though Fiscal year 2016 has ended there are few Taxes of 2016 that are due this month i.e. January 2017. Below are the list of Tax Forms that are due by January 2017 & those are supported by www.Taxexcise.com – a Product of Think trade Inc. Continue reading 2016’s Taxes that are due by January 2017!