The doors of Tax2290 were wide open, this time offline, in position for the much awaited entry of an otherwise busy tax professional (TP hereafter). In a blue jean and white formal shirt he came in and took his interview-ready clean seat. “Sorry for eating up some of your precious time this tax season”, said one of our Tax2290 professional (T2290P hereupon) with a gentle smile.

TP: Oh not really! e-file makes it pretty easy these days.

T2290P: Happy to be servicing professionals like you any day. So, everyone’s talking about going paperless including the IRS. What does this mean for you?

TP: Of course, it means tax returns would be filed electronically instead of filling out in papers and mailing them to the IRS for processing. Now that’s not as easy as just said. It involves a lot of overhead related to postage charges, errors and cycles of corrections. The IRS has made it mandatory that any tax professional who prepares 11 or more tax returns has to electronically file all of those returns. This also means that your tax preparer is as well getting transitioned to being paperless as well. More and more tax professionals are storing their back-up documentation and past tax returns electronically as PDF’s. So, e-filing for clients on websites like yours makes our life as tax professionals so easy and I only wish this was available years ago itself for I would not have seen my dad getting troubled with papers and tension all around him. (Smiles)

T2290P: What would you point out as advantages of e-filing to clients who come to you or in general to those who file Form 2290 themselves online?

TP: You go green immediately, contributing your little part to pause the green-eating society. The ability to file your tax returns round the clock throughout the week right at your desk at home makes life very comfortable and easy. The speed of the entire tax return process dramatically increases with e-filing over paper due to advanced internet capabilities thus saving you money and energy worked out on postage/fax/courier/delivery charges, which of course can be used over a million other valuables. You can readily keep yourselves away from legendary difficulties like waiting endlessly for approvals, moving here and there for additional information etc because everything is checked and verified for errors right at the tax internet stop. And to add pie to all this, comes your schedule 1 copy to your desk within minutes as a proof of payment. What more reasons does anyone need to use e-file services online?

T2290P: Ahh. If only I was a trucker, I would have immediately used such a tax life pacifier. So one last question. How strongly would you recommend the e-file option this tax season for its safety?

TP: I have long been a serious advocate of the electronic filing (e-file) system. In my experience in both paper as well as today’s modernized e-file systems, I can confidently say e-filing tax returns is definitely quicker than mailing a paper return, much secure, and certainly reduces the risk for errors. It doubtlessly saves time and reduces headache for all the parties involved as long as the files are securely stored over the internet like now. I’d rather have ten years worth of CD’s on my shelf than ten years worth of boxes. Does anyone need anything stronger?

Before we could send him off in warmth for spending some valuable time with us, his phone rang and we could hear him say “Yes. Please stay right there. Am coming in minutes. And yes, I do use only e-file system for Form 2290 this season so you don’t have to worry too much.”

He turned to us and said, “Thanks for this interview. I hope everything will shine like sun this season. Bye” and we said, “Thanks a ton for your time. Bye.”

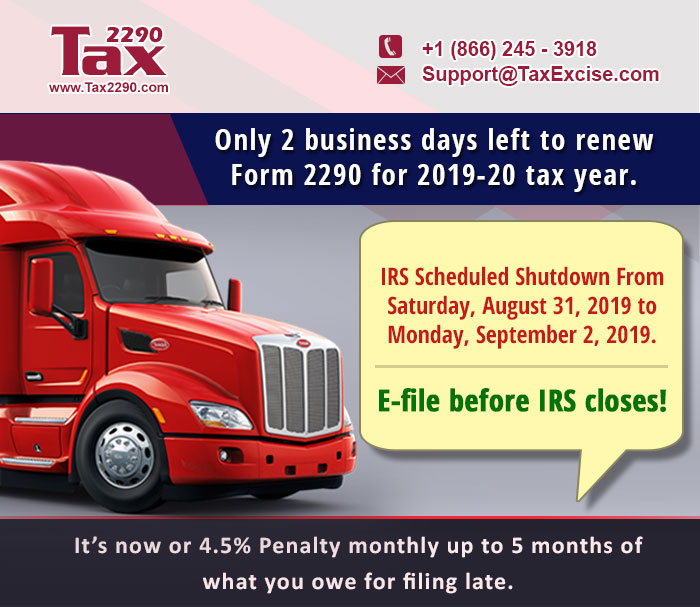

Not to forget, the closing date for filing Form 2290 for the year 2012-2013 is, the 31st of August, 2012. Get back to your computer-facing seats before that and start the e-file form 2290 process at Tax2290.com. Need assistance in between, make a call @ 1-866-245-3918 or write to support@taxexcise.com.