Time just flies away! It just feels like yesterday when we all welcomed the year 2019. But it’s already 70 days old. Today is the 71st day of the year 2019. 2019 is not only 70 days old but your Business Income taxes are due this week. This is also the 11th week of the Year 2019 and today is the 11th Tuesday of 2019. Exactly in four days that is the 11th Friday of 2019 you have to file & pay your Business Income Tax. If not you are not really going to enjoy the rest of the year. Continue reading One Last Week Left to E-file your Extension Form 7004!

Time just flies away! It just feels like yesterday when we all welcomed the year 2019. But it’s already 70 days old. Today is the 71st day of the year 2019. 2019 is not only 70 days old but your Business Income taxes are due this week. This is also the 11th week of the Year 2019 and today is the 11th Tuesday of 2019. Exactly in four days that is the 11th Friday of 2019 you have to file & pay your Business Income Tax. If not you are not really going to enjoy the rest of the year. Continue reading One Last Week Left to E-file your Extension Form 7004!

E-file for an Extension on Your Business Income Tax Today!

“Make sure you pay your taxes; otherwise you can get in a lot of trouble”– Richard M. Nixon

“Make sure you pay your taxes; otherwise you can get in a lot of trouble”– Richard M. Nixon

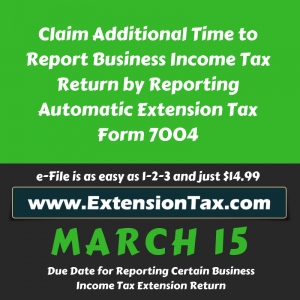

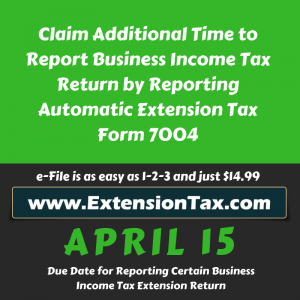

The Trouble Richard was quoting is right around the corner. YES! You read that right, March 15th, is your deadline to file and pay your Business Income taxes for 2018. Not everyone is prepared to file their Business Income Taxes, due to lack of paper work or lack of time.

Though March 15th 2019 is the official deadline to file your Business Income taxes, it is not the end of the road for you. You can legally, postpone your Official Tax Due date to September by simply E-filing Federal Extension Tax Form 7004. Form 7004– Application for Automatic Extension of Time to File Federal Business Income Tax Return. Continue reading E-file for an Extension on Your Business Income Tax Today!

Avoid IRS Penalties, E-File Tax Returns Before the Deadline!

The most common IRS penalties are for not filing on time and not paying on time. There are almost 150 penalties in the Internal Revenue Code, but these two very common penalties make up 74% of all. 60% of all is Failure to pay penalty, imposed if you don’t pay taxes on time. And 14% is Failure to file penalty, imposed if you don’t file a return on time. That means majority of the total tax payers either miss to file returns on time or miss to pay tax due on time.

A failure to file or failure to pay penalties are charged on returns filed after the due date or taxes paid after the due date. Although one can request for the penalty abatement but that could take up to three to nine months’ time and loads of hassles before a successful relief.

You may find it easiest to hire an accountant for a timely filings and payments to save you from all but generally accountants charge a very high fees to get your job done. Taxpayers can potentially save their time and these additional money by shifting their tax return preparation and filings to www.TaxExcise.com. The inevitable rush to file returns by the tax deadlines, the human mistakes due to the rush and penalties due to missing deadlines; can all be avoided if you e-file your tax returns with TaxExcise.com.

www.TaxExcise.com is the first and decade old IRS e-file service provider that can e-file any excise tax returns mentioned below:

- Due by August 31 for yearly renewal OR following month end for new vehicles.

- To obtain IRS waterproof Schedule-1 copy with unlimited vehicles within minutes.

- Gross Weight, VIN correction and Mileage limit Amendments.

Quarterly Excise Tax Form 720:

- Quarterly taxes due on JAN 31, APR 30, JUL 31, and OCT 31 in a calendar year.

- Including the PCORI taxes due in Q2 of each year

All Form 8849 Refund Claims : (Schedules 1, 2, 3, 5, 6 and 8)

IFTA Tax returns online preparation:

- All US states and Canadian Provinces.

- Quarterly taxes due on JAN 31, APR 30, JUL 31, and OCT 31 in a calendar year.

Excise Tax Form 720 and IFTA for 4th Quarter of 2018 & Form 2290 for Vehicles 1st used in December 2018, were due on January 31. If you missed the deadline, give us a try!

For any questions & help feel free to reach us anytime @ 1-866-245-3918 or write to us in support@taxexcise.com or Ping us using the LIVE CHAT Option on the website.

Prepare and File your 4th Quarter IFTA Return for 2018

The deadline to file your 2018’s 4th Quarter IFTA Return is January 31, 2019. A Quarterly IFTA Tax Return must be filed even if the licensee does not operate or purchase any taxable fuel in an IFTA member jurisdiction during the quarter.

Required Information:

- Mileage log-whether you use manual trip sheets, GPS, or electronic trip sheets; it is not only necessary to have in order to file your quarterly IFTA return, but you will need these if you are even audited.

- Fuel Receipts-you will need to know how many gallons of fuel were purchased in each state.

Methods to prepare and file your return:

Continue reading Prepare and File your 4th Quarter IFTA Return for 2018

E-file HVUT Form 2290 Before the IRS Year-end Shutdown!

Blessed is the season which engages the whole world in a conspiracy of love – Hamilton Mabie

Before we get on to the serious topic of IRS Yearend E-file Shutdown, www.Taxexcise.com / www.Tax2290.com – Products of ThinkTrade Inc., would like to take this Opportunity to wish you and your Family a Merry Christmas and Happy holidays. Though we know that ever busy Truckers may not find time to spend time with their loved ones but we would like to thank them for making our Holidays a memorable one, without them there would be no happy holidays for any one of us.

OK Now back to business, this time it’s really important, Continue reading E-file HVUT Form 2290 Before the IRS Year-end Shutdown!