We at TaxExcise at this time of a global crisis do understand your needs, and wouldn’t want you to miss out on the upcoming deadlines. The clock is ticking, as businesses are closed your work is piling up, that strict timeline is looming over your head and it’s seemingly more and more unlikely that you will meet the deadline. Even though the deadline for a considerable number of forms and payments have been postponed, there are still a handful of tax forms that have not been extended by the IRS and Form 2290, Form 720 and IFTA are namely a few.

Form720 is filed every quarter to report taxes imposed on the manufacture, sale or use of certain type of goods and products, the deadline to have this reported for the 1st quarter of 2020 is April 30.

Due to the current situation with the lockdown still in effect, the most common question we had come across is “Do we still need to file form 720 if we do not have any excise tax to report?“

The answer is “Yes”, though you have not made any sale that includes Excise tax you will still need to file form 720 by reporting a Zero Return (Zero Tax Liability).

Form2290 needs no introduction, as most truckers are already aware that this form needs to be completed when a vehicle is first used or placed into service during a tax year. The April 30th deadline is for trucks that started operations and were first used anytime during the month of March.

Preparing your IFTA tax report is fast, easy and more convenient when done online. Prepare your report for the First Quarter of 2020 before the April 30th deadline.

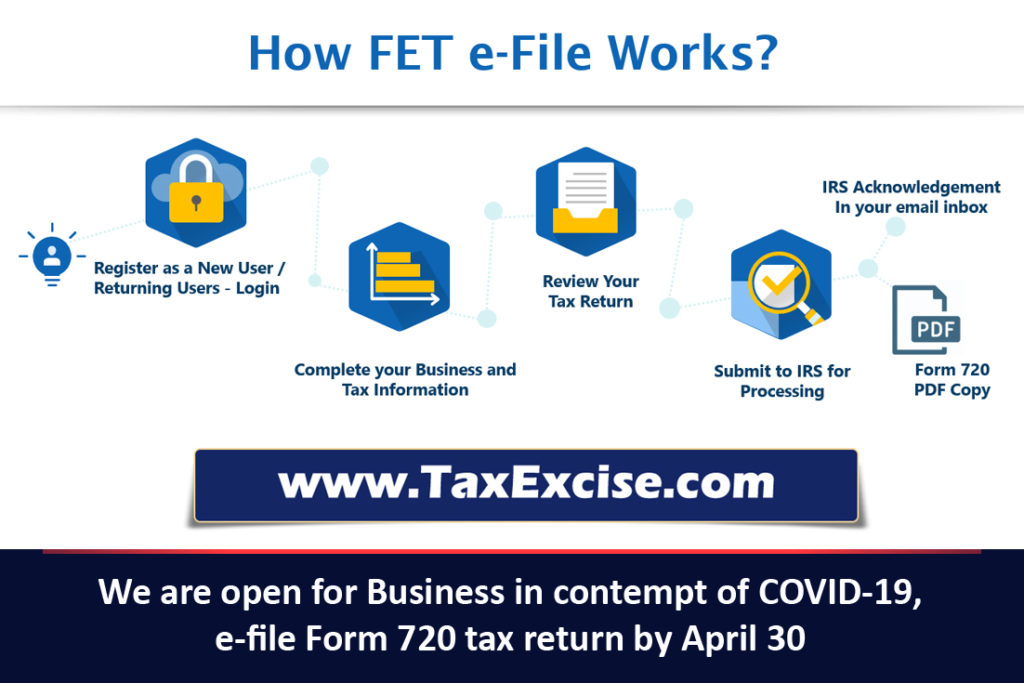

This April deadline happens to be the one that always stands out as it revolves around 3 tax forms that serve a different purpose. You can always depend on our E-file services that is currently open and processing returns online. Though the IRS offices are not operational, their E-file services are online and tax returns are currently being processed with a turn-around time of a few minutes.

Due to the COVID-19 Outbreak we at www.TaxExcise.com have initiated a contingency and business continuity plan to ensure that all our resources are at your assistance. If you have any questions or need any help in completing federal tax returns feel free to call our Help Desk @ 866-245-3918 or email us at support@taxexcise.com do also try out our Live Chat option available on the website. We’re available on all Business days between 9:00 am to 6:00pm Central Time.

Stay Safe, Stay Strong, we are in this together.