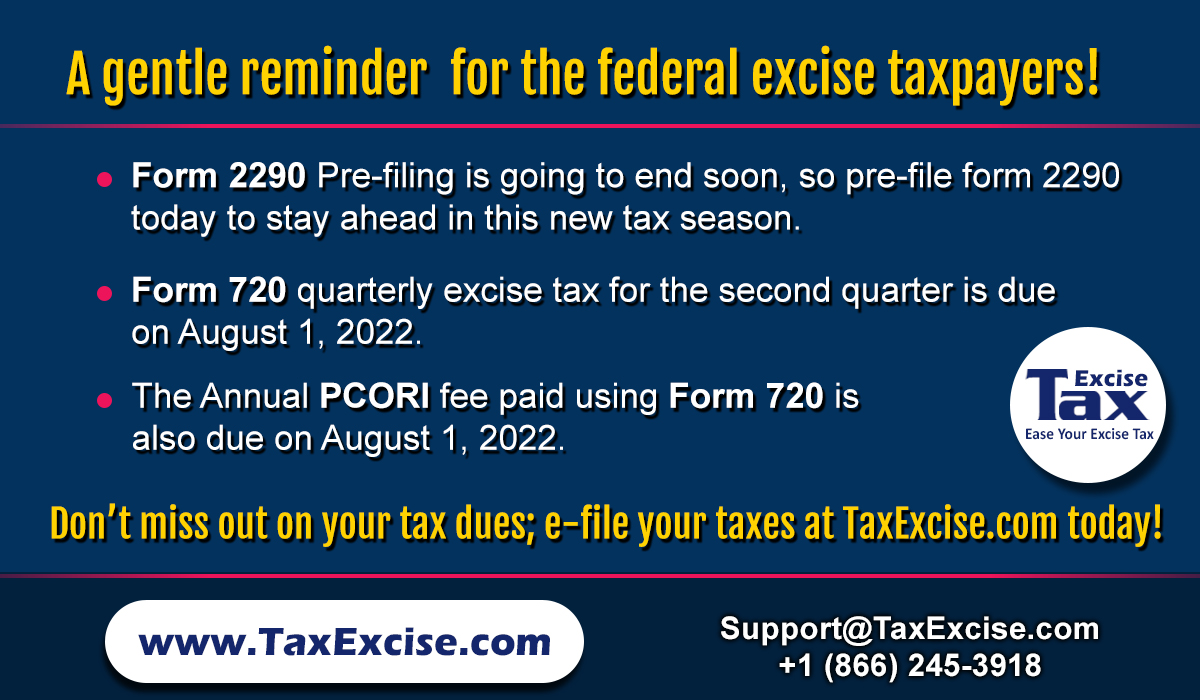

Ahead of the upcoming truck tax year, we have been successfully providing form 2290 pre-filing services for the benefit of truckers to pre-file form 2290 online. Many truckers and truck taxpayers had already made use of this opportunity and completed their form 2290 online pre-filing ahead of the upcoming tax year, 2022-2023. If you haven’t done your form 2290 pre-filing, don’t miss out on this chance to pre-file form 2290 online at TaxExcise.com.

The federal excise tax form 720 e-filing has been successfully done for the first quarter at TaxExcise.com. The due date for form 720 second quarter of this tax year is approaching soon. So, prepare to e-file form 720 excise taxes before the deadline.

TY 2022-2023 is just a few days away!

The new tax season for this year, TY 2022-2023, is coming up in just a few days. Every year, the tax period starts around the first week of July and lasts till the end of next June. So, the taxpayers should report and pay the form 2290 truck taxes in advance for the entire tax year. They should file form 2290 and get the schedule 1 copy as the acknowledgment to continue the trucking operations smoothly. And they should report the form 2290 HVUT within the end of August, which is the deadline to file the form 2290 to the IRS.

Pre-file form 2290 HVUT at TaxExcise.com!

IRS only accepts form 2290 at the beginning of the tax season. Therefore, the IRS will get crowded with lots of form 2290 filings and requests. This swarm of form 2290 truck taxes will create a delay in form 2290 truck tax processing from the IRS. But the truck taxpayers should complete filing their form 2290 truck taxes and get the schedule 1 copy within the deadline. To beat the crowds and give our customers a head-start in form 2290 truck tax preparations, TaxExcise.com has been providing HVUT form 2290 pre-filing services that enable the truckers and trucking taxpayers to e-file their form 2290 tax reports ahead of the tax season. We start accepting form 2290 tax reports days or even a month before the beginning of the tax season. In form 2290 pre-filing at TaxExcise.com, you can prepare and report the form 2290 tax returns for the next tax season before it even starts. We will securely hold your form 2290 reports in our system and transmit them to the IRS once they open for the season. Form 2290 pre-filing gives you ample time to prepare your truck tax reports and efile them. You can relax during the beginning of the tax season because your form 2290 reports will be among the first reports to reach the IRS for processing. Then you can complete your form 2290 tax payments easily through any online means and get the official schedule 1 copy to your registered email address.

Form 720 for the second quarter is due soon!

Certain businesses are liable for federal excise taxes to the IRS every year, and they need to pay these taxes on a quarterly basis. The federal excise taxes are paid using form 720 for every quarter by choosing the right part and the line. The form 720 federal excise tax for the second quarter is due on August 1, 2022. So, the federal excise taxpayers should e-file form 720 within the deadline to avoid penalties and late charges from the IRS.

The annual PCORI fee is paid using the federal excise tax form 720. The Patient-Centered Outcomes Research Trust Fund fee on the issuers of specified health insurance policies and plan sponsors of applicable self-insured health plans help fund the Patient-Centered Outcomes Research Institute (PCORI). The PCORI fee is paid only once a year during the second quarter of the tax year to the IRS. It is also due on August 1, 2022.

E-filing form 720 is easy, smooth, and accurate at TaxExcise.com. You can follow the steps in our online platform to successfully e-file form 720 online. Or you can contact our customer support desk (1 – 866 – 245 – 3918) to assist you in your form 720 e-filing process.

Visit TaxExcise.com, register for free, pre-file form 2290 before the time runs out, and e-file form 720 for the second quarter today!