Federal Excise Taxes are taxes paid when purchases are made on a specific good, such as gasoline. This excise taxes are often included in the price of the product and collected from the buyer and paid at end of every quarter with the IRS. There are also excise taxes on activities, such as on wagering or on highway usage by trucks. One of the major components of the excise program is motor fuel, offering services like indoor tanning services, PCORI etc.

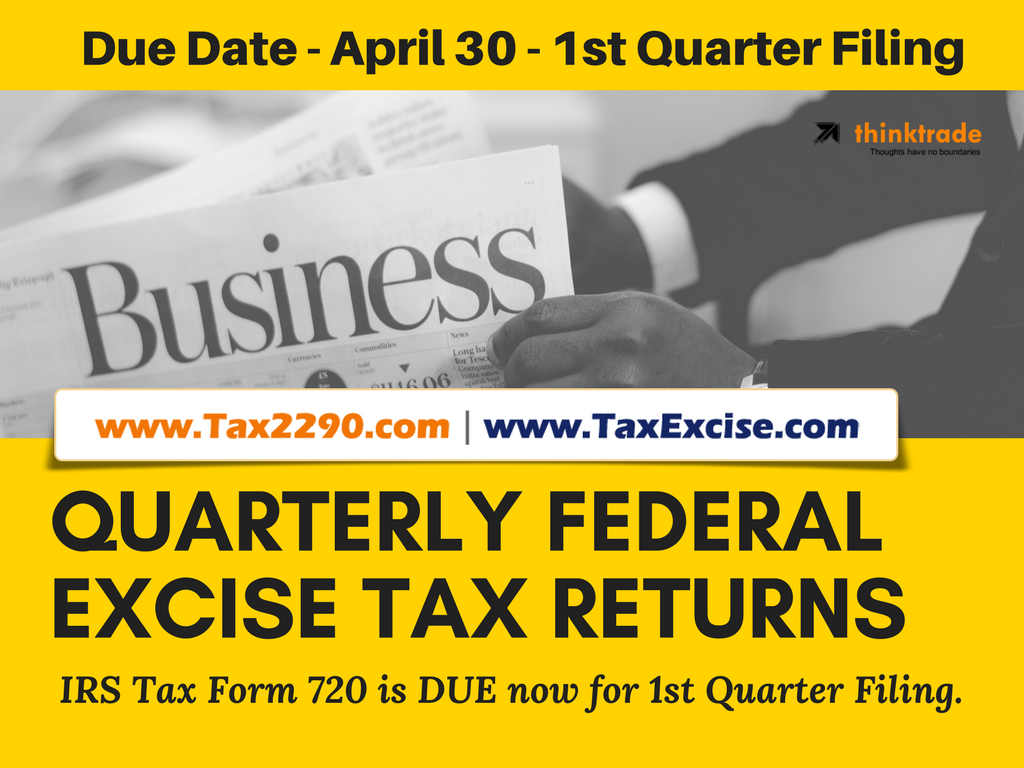

1st Quarter Federal Excise Tax Due on April 30

The first quarter federal excise taxes that a business has collected will consolidate it in the IRS Tax Form 720, and report it with the IRS by end of a quarter and pay, it is due this April 30.

Continue reading Quarterly Federal Excise Tax Returns for 1st Quarter is Due this April 30

Continue reading Quarterly Federal Excise Tax Returns for 1st Quarter is Due this April 30

May we have your attention please, Less than 48 hours in hand to File Three Tax Form that are due TOMORROW January 31st 2018. Being an IRS Authorized E-file Service Provider it becomes our responsibility to remind Every Tax Payer about upcoming tax Deadlines for the month and where to get it done with ease.

May we have your attention please, Less than 48 hours in hand to File Three Tax Form that are due TOMORROW January 31st 2018. Being an IRS Authorized E-file Service Provider it becomes our responsibility to remind Every Tax Payer about upcoming tax Deadlines for the month and where to get it done with ease. 2018 has just begun, but we are almost at the end of the first month of 2018. Interesting thing about the month of January is that you have three tax deadlines colliding on the same day January 31st.

2018 has just begun, but we are almost at the end of the first month of 2018. Interesting thing about the month of January is that you have three tax deadlines colliding on the same day January 31st. Great News for all the Excise Tax E-filers! IRS E-file Servers are now Operational and ready to accept and process business Tax returns. The IRS E-file servers were shutdown for yearend maintenance like every year by Christmas. They resumed operations only from Yesterday (09.01.2018).

Great News for all the Excise Tax E-filers! IRS E-file Servers are now Operational and ready to accept and process business Tax returns. The IRS E-file servers were shutdown for yearend maintenance like every year by Christmas. They resumed operations only from Yesterday (09.01.2018).