The Strongest fact about time is that “IT CHANGES”, it does not stay put for anyone. I will hit the gym tomorrow said all those obese people out there and never did. Procrastinating important things in life is very easy but, consequences faced due to the pinch of laziness we add to our schedule has devastating setbacks attached to it. Statistics says that people postpone things that are less frequently done.

The Strongest fact about time is that “IT CHANGES”, it does not stay put for anyone. I will hit the gym tomorrow said all those obese people out there and never did. Procrastinating important things in life is very easy but, consequences faced due to the pinch of laziness we add to our schedule has devastating setbacks attached to it. Statistics says that people postpone things that are less frequently done.

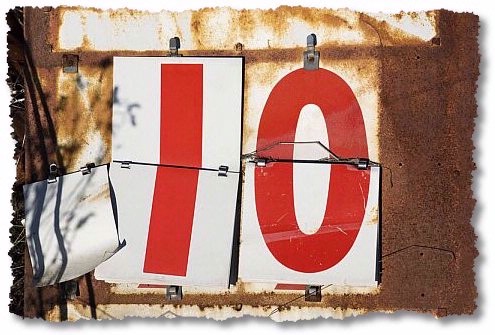

One such thing that does not show up on calendars very often is the Filing of Federal Excise Tax Form 720. Though it knocks our door only Four times a year, missing to E-file it on time has huge penalties & added interests which could even be more than the taxes owed. Gone are those days when the IRS Mails us the Form 720 and we complete it and mail it back to them. Even taxes have become advanced & have joined hands with technology to go paperless. Continue reading ONLY Ten Working Days Left to E-file your 3rd Quarter Form 720