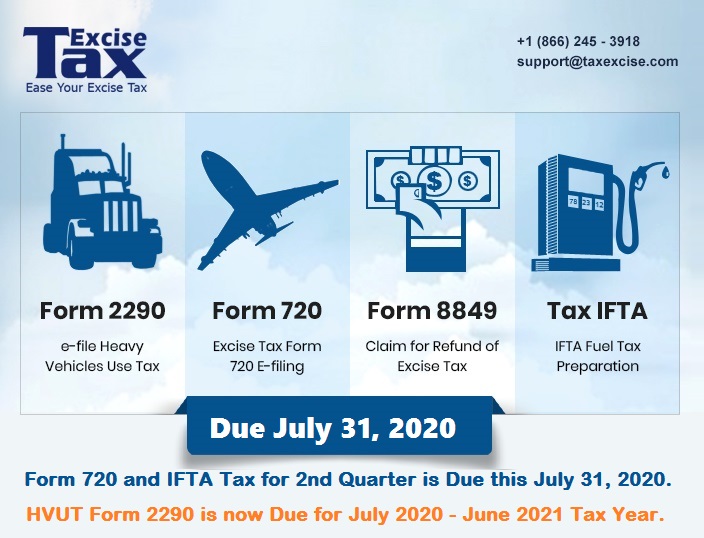

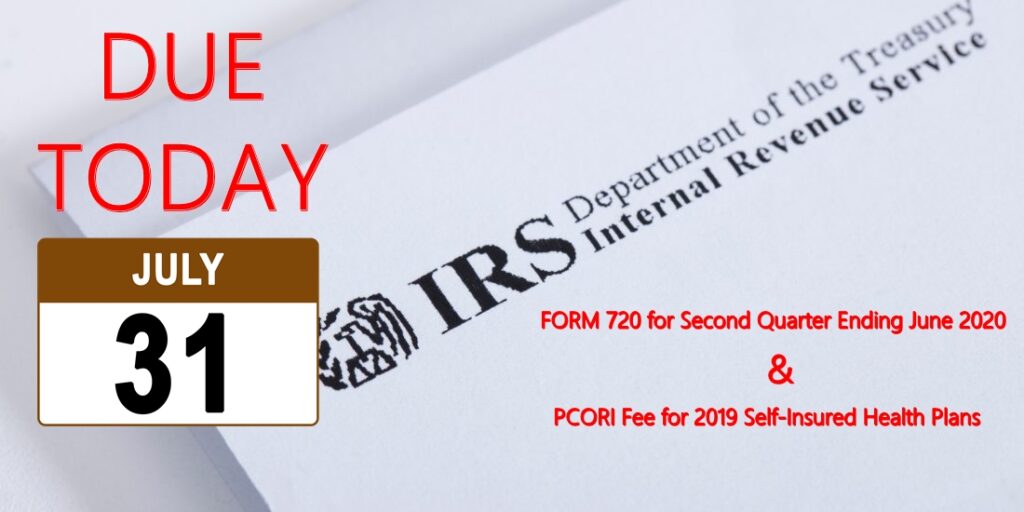

TaxExcise.com the only E-file service provider that helps to report all the federal excise tax forms and all schedules of Form 8849 refund claims would like to remind taxpayers that the excise tax form 720 for the second quarter of 2020 ending in June 30th and PCORI Fee, is DUE TODAY.

PCORI FEE:

Patient-Centered Outcomes Research Institute (PCORI) fees are also due TODAY. 2019 PCORI must be reported on the second quarter of 2020. While filing your return using www.TaxExcise.com, please select the year Jan – Dec 2020 and quarter ending in June 2020, and have your 2019 PCORI filed. The PCORI annual filing and fees was originally set to expire in 2019, but they were reinstated for an additional 10 years, through 2029.

Form 720 and Form 2290 tax requirements for small businesses:

Continue reading Form 720 is due TODAY for second quarter of 2020 and PCORI Fee for 2019 Self-Insured Health Plans