As per the IRS Notice 2020-48, There are certain relief for excise taxpayers report and pay the excise taxes on sport fishing equipment, bows and arrows etc. filing deadline has been extended further. The Form 720 due on July 31, 2020, covers the second calendar quarter (April, May, June) of the year 2020. Refer to the notice here.

Any person (as defined in section 7701(a)(1) of the Code) with a federal sporting goods excise tax payment due and the requirement to file a return under the sport fishing and archery equipment on July 31, 2020, is determined to be affected by the COVID-19 emergency for purposes the July 31, 2020, due date for filing Form 720 for the sport fishing and archery equipment numbers and making corresponding federal sporting goods excise tax payments is automatically postponed to October 31, 2020. This relief is automatic. Affected Taxpayers do not have to call the IRS, file any extension forms, or send letters or other documents to receive this relief. An Affected Taxpayer may file a Form 720 for excise taxes and pay the corresponding excise taxes on sport fishing and archery equipment by the normal due date (July 31, 2020) if the Affected Taxpayer so chooses. An Affected Taxpayer who takes advantage of this postponement should file only one Form 720 for the sport fishing and archery equipment numbers by the postponed deadline of October 31, 2020, on an IRS Number line if the taxpayer has excise tax liability for the tax corresponding to that Number and this Notice postpones the payment of that tax (in other words, avoid duplicate filings).

Electronic Filing is the best possible support to help you report and pay the Federal Excise Tax returns online. Electronic filing enables you to prepare your tax returns by yourself and this self-serviced website will help us to fulfill your tax compliances conveniently and comfortably from your home. https://TaxExcise.com, can help you with a simple and easy process, quick and fast acknowledgment. We can guarantee that you wont miss out any thing when you efile and you wont be sending in a incomplete tax return to the IRS.

Economic filing as the price is at the nominal side, $49.99 per filing. The most affordable than reaching out to the tax preparer or tax accountant where the reporting fee would be in $$$$. TaxExcise.com has a dedicated support line to help you through. Talk to us at 866 – 245 – 3918 or write to us at support@taxexcise.com.

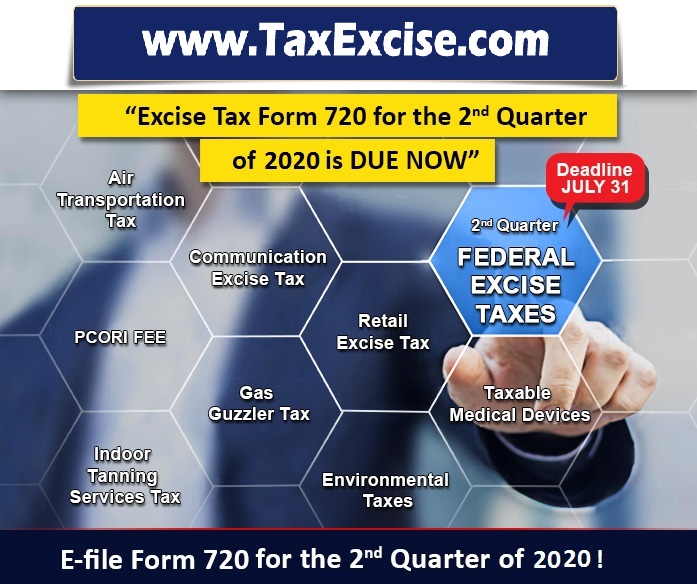

July 31 – Deadline – Choose Efile

Other excise taxpayers, July 31 is the last date to report and pay the 2nd Quarter Federal Excise Tax returns. PCORI Fee is usually reported in the 2nd Quarter return of Form 720 and this is already been extended to next 10 years. Try electronic filing to report the Indoor Tanning Service Excise Taxes that is collect from the customers by the service providers. Fuel Excise taxes and others excise taxes related to the goods and service also falls due by July 31. Choose Efile for faster processing of the Federal Excise Tax returns and easy steps to complete it by yourself. Self Serviced website http://TaxExcise.com is the preferred partner with many businesses that report and pay Federal Excise Taxes.