“This is a question too difficult for a mathematician. It should be asked of a philosopher”(when asked about completing his income tax form)” ― Albert Einstein. Taxes are something that one cannot avoid till he/she is alive; likewise if you own a business you will have to file a list of taxes to keep your business alive. One such Tax is Federal Excise Tax, filed through Form 720 every quarter.

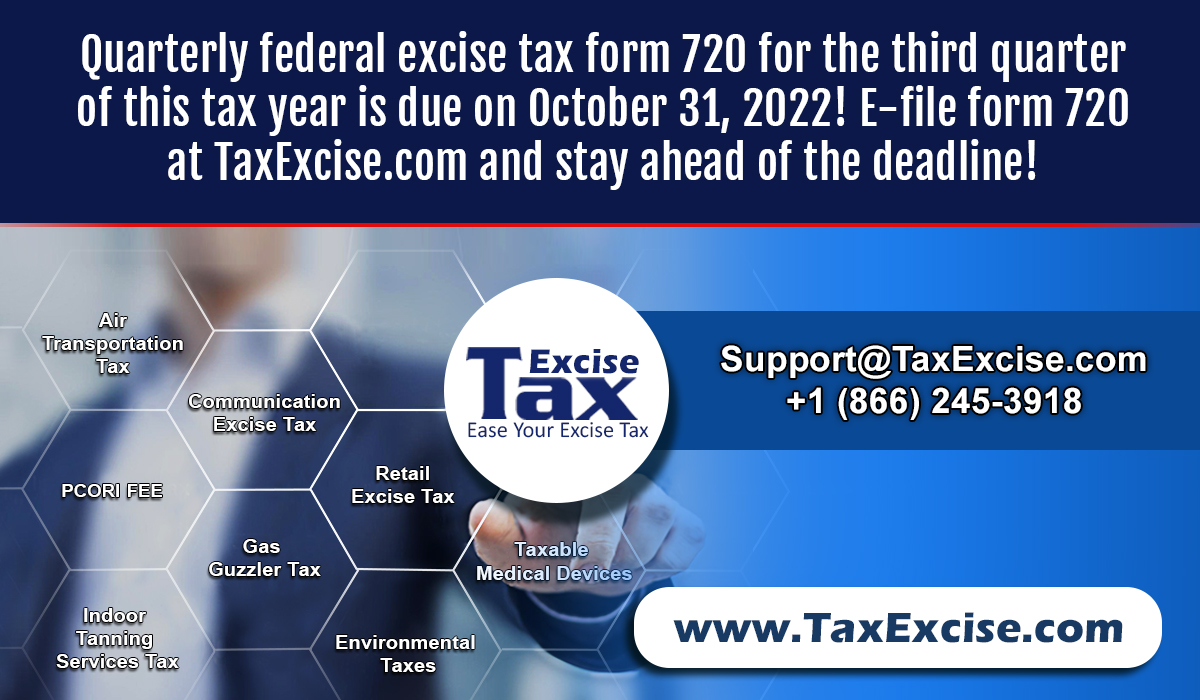

Any business that deals with goods and services are subject to excise tax, it must prepare a Form 720 quarterly to report the tax to the IRS. Ways to prepare and file your taxes are only two, Either your fill out a paper form, figure out complicated calculations and mail it to the IRS or E-file your Form 720 through www.Taxexcise.com , “THE ONLY E-FILE SERVICE PROVIDER FOR FORM 720”.

Below is the list of Major Tax Categories filed through Form 720: Continue reading Excise Tax Categories that are reported through Excise Tax Form 720 →

Continue reading Form 720 for the third quarter is due on October 31. E-file form 720 now!

Continue reading Form 720 for the third quarter is due on October 31. E-file form 720 now!

The Strongest fact about time is that “IT CHANGES”, it does not stay put for anyone. I will hit the gym tomorrow said all those obese people out there and never did. Procrastinating important things in life is very easy but, consequences faced due to the pinch of laziness we add to our schedule has devastating setbacks attached to it. Statistics says that people postpone things that are less frequently done.

The Strongest fact about time is that “IT CHANGES”, it does not stay put for anyone. I will hit the gym tomorrow said all those obese people out there and never did. Procrastinating important things in life is very easy but, consequences faced due to the pinch of laziness we add to our schedule has devastating setbacks attached to it. Statistics says that people postpone things that are less frequently done.