The IRS Tax Form 720 is used to report and pay the Federal Excise tax returns with the IRS. Taxes are filed year on year, quarter to quarter; yes, another year, another tax return. We inch closer to the 2nd quarter filing deadline, July 31 is the last date to get it reported with the IRS.

IRS Tax Form 720 – Federal Excise Tax Reporting

Many of the business taxpayers who deal with specific goods or services that are manufactured in or imported into the U.S. incur Excise Taxes which is often included in the price of the product, like gasoline or alcohol, so you might not even realize you’re paying them. Let us redefine some of the general question exactly what is Form 720? What is an excise tax? Well before starting with Form 720, let us know that IRS Form 720 consists of three parts, as well as Schedule A, Schedule T, and Schedule C sections and a payment voucher (called Form 720-V). If your business is responsible for completing Form 720, you must do so quarterly and can file electronically or by mail. Payments for excise taxes, however, are required on a semimonthly basis and should be made by electronic funds transfer.

What is Form 720?

Quarterly Federal Excise Tax Form 720 is used for reporting federal excise tax liabilities on certain products (gasoline and fuel) and services (tanning salon and PCORI). These are excise taxes on activities, such as on wagering or on highway usage by trucks. One of the major components of the excise program is motor fuels. Federal Excise Tax Form 720 and attachments are to report to the IRS at end of every quarter listing the liabilities and pay the taxes collected.

What is an Excise tax?

You must file Federal Excise Tax if you were liable for, or responsible for collecting, any of the federal excise taxes listed on Form 720, Parts I and II, for a prior quarter or for the current quarter and you haven’t filed a final return. In other words, if you own a business that deals in goods and services subject to excise tax, you must prepare a Form 720 quarterly to report the tax to the IRS. The federal government charges an excise tax on specific types of products and services, which has to be collected and paid to IRS at regular intervals, quarterly.

When is Form 720 due?

You must file a return for each quarter of the calendar year as follows.

| Reporting Quarter | Due Date |

|---|---|

| January – March | April 30 |

| April – June | July 31 |

| July – September | October 31 |

| October – December | January 31 |

Part 1 of Federal Excise Tax Form 720

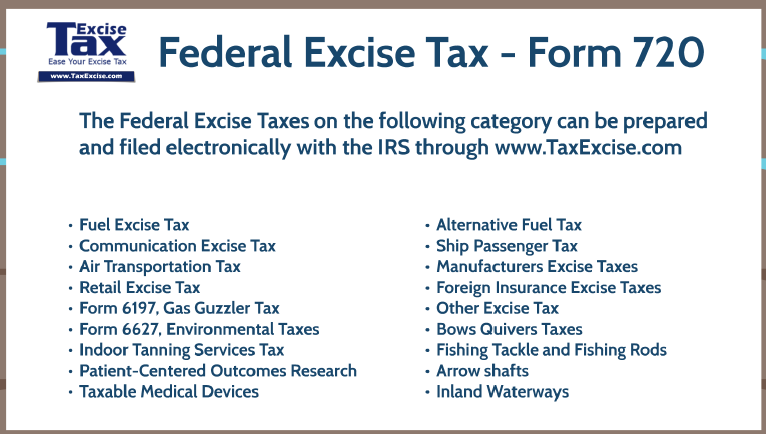

In the Part I of Form 720 various taxes are listed and if a business deals with it then they would need to pay the following taxes. The person receiving the payment for a service or goods must collect and submit the tax and file the Form 720 return. Enter the amount of tax collected or considered collected for the quarter.

- Environmental taxes—petroleum oil spills, imported petroleum products, ozone-depleting chemicals (if you must pay these environmental taxes, you’ll also have to complete IRS Form 6627)

- Communication and air transportation taxes—phone service or air transportation

- Fuel taxes—diesel, kerosene, gasoline, natural gas

- Retail tax—trucks, trailers, tractors

- Ship passenger tax

- Foreign insurance taxes—health insurance policies issued by foreign insurers

- Manufacturers taxes—coal, tires, “gas guzzler,” vaccines

Part 2 of IRS Tax Form 720

Part 2 of the Federal Excise Tax would directly deal with certain services and goods that are qualify under excise taxes, and they are

- PCORI fee – Patient-Centered Outcomes Research Fee

- Specified health insurance policies

- Sport fishing equipment

- Electric outboard motors

- Bows and arrows

- Indoor tanning services

- Waterways fuel

- LUST tax

- Floor Stocks Tax

- Bows, quivers, broad heads and Arrow shafts

Essentially, Part II will be reported accordingly based on the services and goods sold. It’s worth noting that the tax for health insurance is calculated differently than the other categories—using the average number of lives covered, as opposed to units sold or total sales.

Part 3 of Form 720 covers, total taxes that you owe and the semimonthly deposits made for the quarter. Over payment adjustments, etc.

Schedule A – Excise Tax Liability of Form 720

The Schedule A section of IRS Form 720 is to be filled out only by businesses that have a tax liability from any tax in Part I of the form. If, on the other hand, you don’t have liability from Part I, but do have liability for Part II, you do not need to fill out Schedule A. Schedule A reports your business’s net tax liability. In Schedule A, you will add the net tax liability for each tax for each semimonthly period.

Schedule T – Two-Party Exchange Information Reporting

Two-Party Exchange Information Reporting, is used to report certain exchanges of taxable fuel before or in connection with the removal at the terminal rack. Both Schedule T and Schedule C are related to businesses that deal with fuel; diesel fuel, kerosene, gasoline, or aviation gasoline.

In a two-party exchange, the person receiving the fuel, not the person delivering it, is liable for the tax imposed on the removal of taxable fuel from the terminal.

Schedule C – Claims of Form 720

Claims is used to make claims. However, Schedule C can only be used if you are reporting a liability in Part I or Part II. Like Schedule T, Schedule C is only applicable to businesses that deal with one of the fuel types (and a few tire types). When you a claim, you may be able to reduce the amount you owe by filing a claim on Schedule C. However, only certain types of fuel and use-cases qualify for a Schedule C claim.

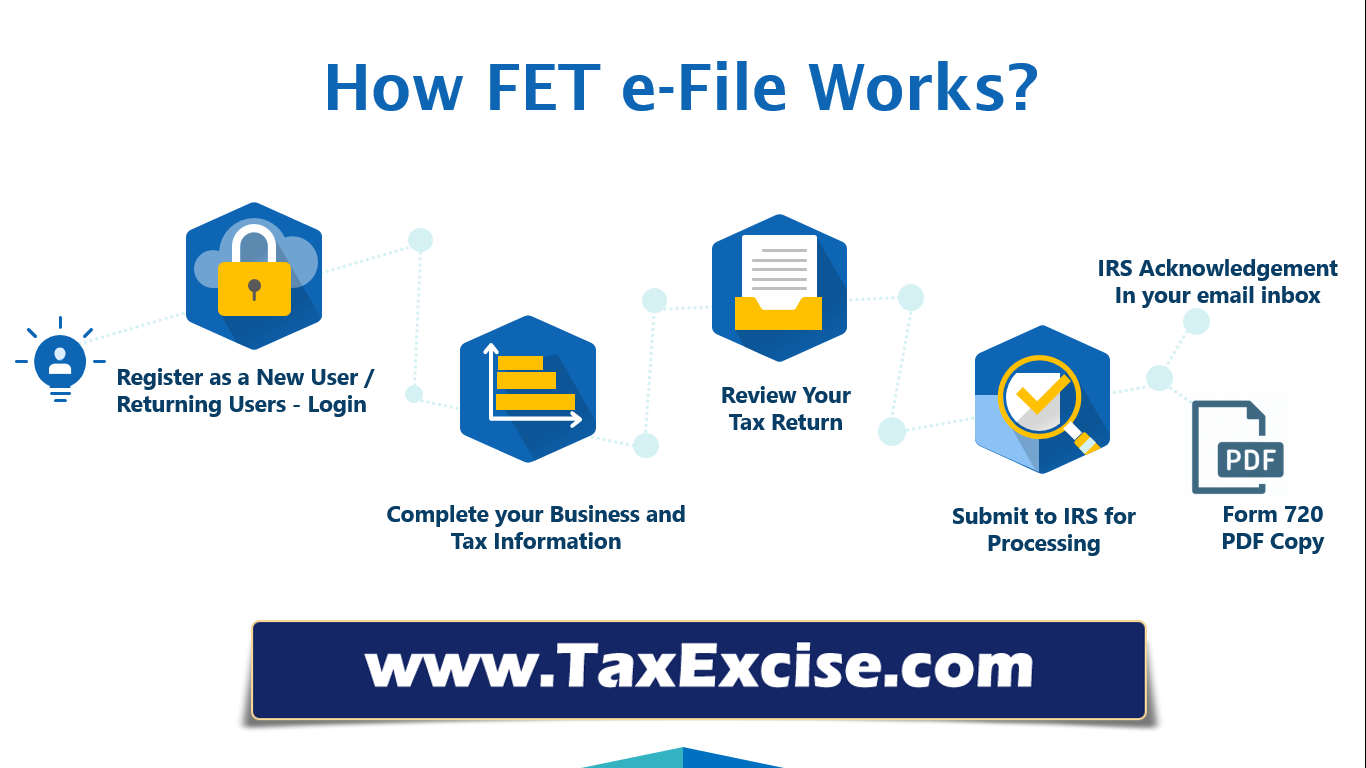

Electronic Filing for Form 720 at TaxExcise.com

Efiling or electronic filing is submitting your federal excise tax returns online to the IRS directly from TaxExcise.com website. There are two ways to filing your federal excise tax returns. The traditional way is the offline way, where you manually fill in directly or through a tax preparer you file your returns. The other way is when you e-file through the internet. E-filing has become popular because it is easier, doesn’t require prints of documents, and can be done in less time!