Before we even realize it, the tax season is here. And all the taxpayers need to stay alert on their respective due dates to file their tax returns and pay the tax dues to the IRS within the deadline to avoid any last-minute mishaps. The IRS will charge late fees, penalties, and interests if you miss the deadline based on your total tax due amount. The interest will be 0.5% to 1% based on your category, and it can go up to 25% per month of the total tax amount. Even 25% interest is unnecessary because you have the option to file a tax extension with the IRS to save you from all these penalties and interests. But IRS doesn’t grant tax extension time to pay your tax due amount. You have to pay at least 90% percent of your total tax amount by the actual deadline. IRS only gives a six-month tax extension time to submit your entire tax reports for the year along with the supporting documents.

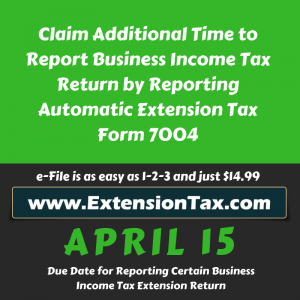

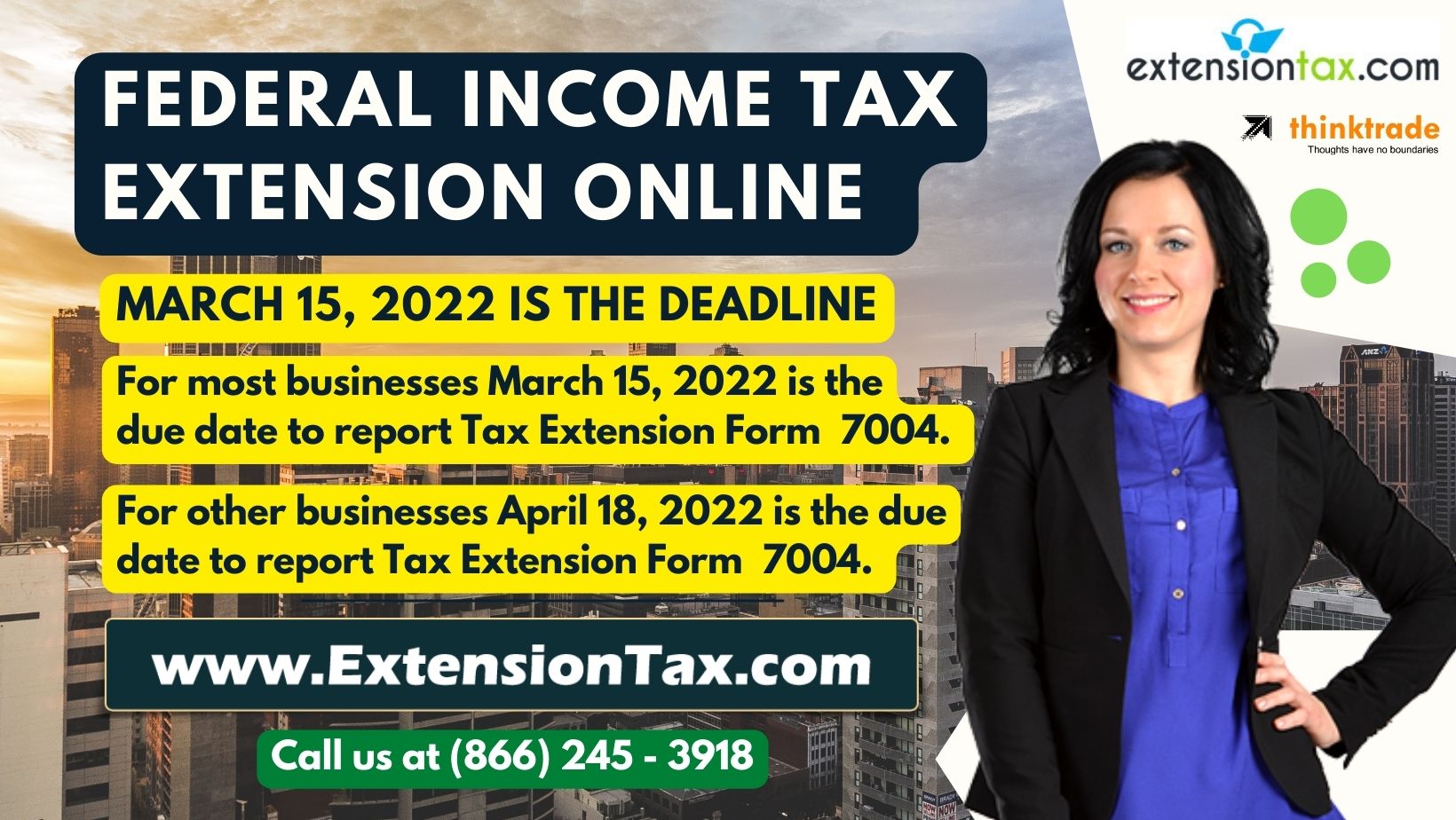

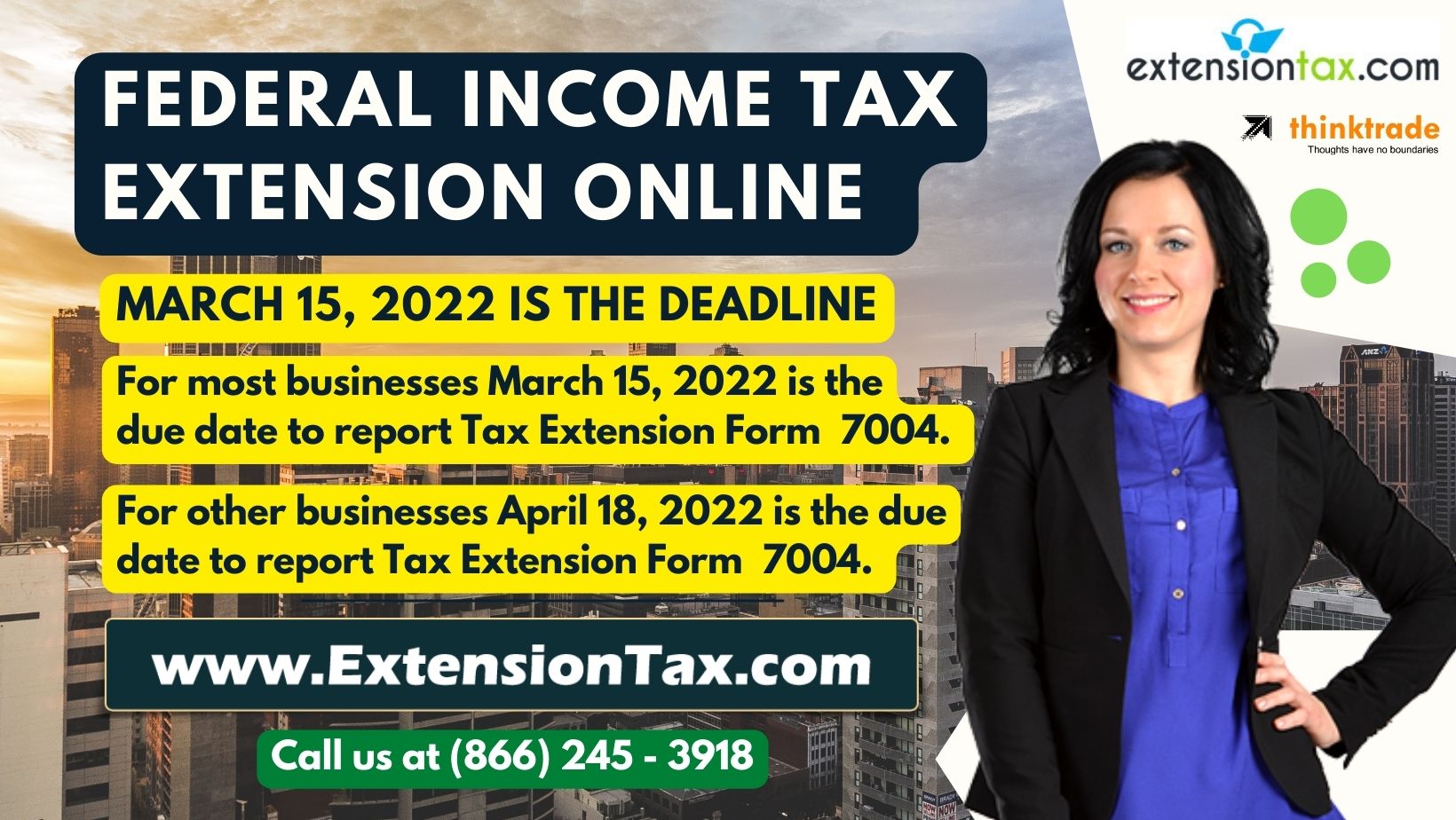

Extensiontax.com provides the best e-filing service for tax extension applications Form 7004, Form 4868, Form 8868, and Form 2350. We are an IRS authorized e-file service provider known for e-filing IRS tax extension forms for business and individual taxes. You can e-file all the above-mentioned tax extension forms to the IRS only at $14.99 per form in extensiontax.com.

Continue reading Why should you file for a tax extension? →

ThinkTrade Inc is authorized and certified by IRS to offer e-filing services for federal excise and extension taxes. There are various Tax Forms, Supported by ThinkTrade Inc under the banner of

ThinkTrade Inc is authorized and certified by IRS to offer e-filing services for federal excise and extension taxes. There are various Tax Forms, Supported by ThinkTrade Inc under the banner of