The deadline to file your 2018’s 4th Quarter IFTA Return is January 31, 2019. A Quarterly IFTA Tax Return must be filed even if the licensee does not operate or purchase any taxable fuel in an IFTA member jurisdiction during the quarter.

Required Information:

- Mileage log-whether you use manual trip sheets, GPS, or electronic trip sheets; it is not only necessary to have in order to file your quarterly IFTA return, but you will need these if you are even audited.

- Fuel Receipts-you will need to know how many gallons of fuel were purchased in each state.

Methods to prepare and file your return:

Continue reading Prepare and File your 4th Quarter IFTA Return for 2018

Time and Tide waits for none! Very old saying but suits every situation especially when it comes to Taxes. April is not only the Month to file and Pay your Personal Income taxes but has few other deadlines as well.

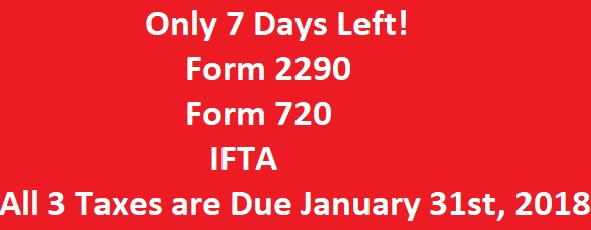

Time and Tide waits for none! Very old saying but suits every situation especially when it comes to Taxes. April is not only the Month to file and Pay your Personal Income taxes but has few other deadlines as well.  May we have your attention please, Less than 48 hours in hand to File Three Tax Form that are due TOMORROW January 31st 2018. Being an IRS Authorized E-file Service Provider it becomes our responsibility to remind Every Tax Payer about upcoming tax Deadlines for the month and where to get it done with ease.

May we have your attention please, Less than 48 hours in hand to File Three Tax Form that are due TOMORROW January 31st 2018. Being an IRS Authorized E-file Service Provider it becomes our responsibility to remind Every Tax Payer about upcoming tax Deadlines for the month and where to get it done with ease. 2018 has just begun, but we are almost at the end of the first month of 2018. Interesting thing about the month of January is that you have three tax deadlines colliding on the same day January 31st.

2018 has just begun, but we are almost at the end of the first month of 2018. Interesting thing about the month of January is that you have three tax deadlines colliding on the same day January 31st. Great News for all the Excise Tax E-filers! IRS E-file Servers are now Operational and ready to accept and process business Tax returns. The IRS E-file servers were shutdown for yearend maintenance like every year by Christmas. They resumed operations only from Yesterday (09.01.2018).

Great News for all the Excise Tax E-filers! IRS E-file Servers are now Operational and ready to accept and process business Tax returns. The IRS E-file servers were shutdown for yearend maintenance like every year by Christmas. They resumed operations only from Yesterday (09.01.2018).