IRS Form 720, or the Quarterly Federal Excise Tax Return, is an IRS tax form that businesses must complete on a quarterly basis in order to report and pay federal excise taxes. An excise tax is a tax that the federal government imposes on specific goods or services that are manufactured in or imported into the U.S. Excise taxes are often included in the price of the product, like gasoline or alcohol, so you might not even realize you’re paying them. However, if your business sells a good or service that is subject to excise tax, then you are responsible for reporting and paying for those taxes—IRS Form 720, therefore, allows you to do just that.

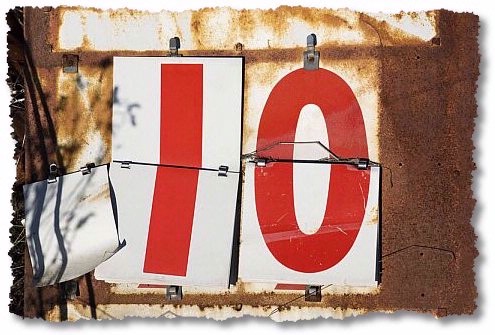

2nd Quarter Excise Tax

The filing deadline for IRS Tax Form 720 is quarterly, needs to be completed and reported by the last day of the first month that follows the end of the prior quarter. July 31 is the last date to report and file the Federal Excise Taxes for 2nd Quarter of 2019.

Continue reading Less than 48 hours to report 2nd quarter Federal Excise Tax

The Strongest fact about time is that “IT CHANGES”, it does not stay put for anyone. I will hit the gym tomorrow said all those obese people out there and never did. Procrastinating important things in life is very easy but, consequences faced due to the pinch of laziness we add to our schedule has devastating setbacks attached to it. Statistics says that people postpone things that are less frequently done.

The Strongest fact about time is that “IT CHANGES”, it does not stay put for anyone. I will hit the gym tomorrow said all those obese people out there and never did. Procrastinating important things in life is very easy but, consequences faced due to the pinch of laziness we add to our schedule has devastating setbacks attached to it. Statistics says that people postpone things that are less frequently done.