Taxes are one of the most challenging and complicated aspects of running a business. There are several forms to fill out, each with its own set of conditions and deadlines. In light of that, businesses who deal with the selling of such products and services must file Form 720. These companies must pay “Excise Taxes,” which are additional taxes.

If the company is in charge of filling out Form 720, you must file it periodically and can do it either online or by mail. The IRS Form 720 has three components, as well as sections for Schedule A, Schedule T, and Schedule C. Excise taxes, on the other hand, must be paid on a semimonthly basis and through electronic funds transfer. A semimonthly period is described by the IRS as the first 15 days of the month (first semimonthly period) or the 16th to the last day of the month (second semimonthly period). Your excise taxes will be calculated as a percentage of gross revenue or a percentage of units sold, depending on your specific business.

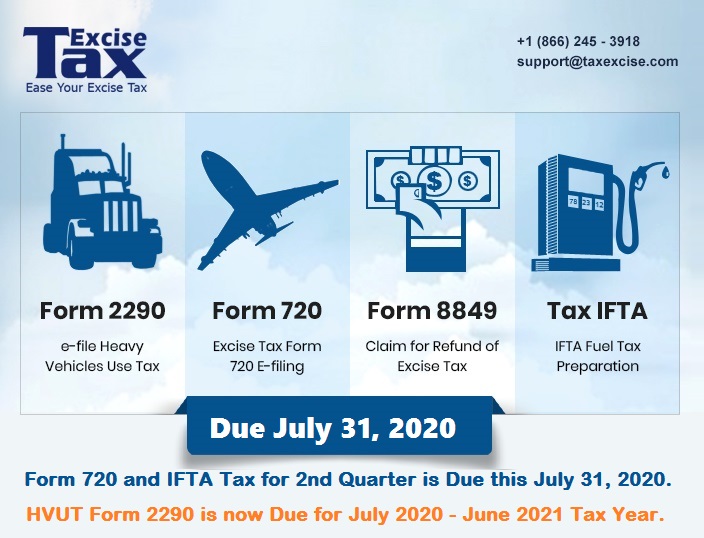

Over a calendar year, this Federal excise tax is divided into four months, with each quarter’s date falling on the last day of the next month, i.e., by April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. The first quarter of 2021 (for the months of January, February, and March) must be submitted by April 30, 2021. Even if you are not responsible for excise taxes during any of the year’s quarters, you must submit Form 720 by the deadlines.

Continue reading The deadline for filing Form 720 for the first quarter of 2021 is April 30, e-file now!