Who is required to file Form 2290 and pay Heavy Highway Vehicle Use Tax?

Anyone who registers a heavy highway vehicle in their name with a gross weight of 55,000 pounds or more must file Form 2290 and pay the tax. Typically, owners of vans, pickup trucks, panel trucks and similar trucks are not required to file Form 2290 or pay tax on these smaller trucks. Trucks that are used for 5,000 miles or less (7,500 for farm trucks) are also excluded from this tax.

Who is required to e-file Form 2290?

IRS encourage all 2290 filers to e-file. If you are reporting 25 or more heavy highway vehicles for any taxable period, you are required to e-file through an IRS-approved software provider Tax2290.com or TaxExcise.com. Electronic filing improves tax processing and saves you personal resources, including time and postage. In addition, e-file reduces preparation and processing errors. You can e-file your return from your own computer, any time of day or night. Use e-file and your IRS Stamped Schedule 1 is available through Tax2290.com or TaxExcise.com immediately after IRS accepts it.

- No more waiting for it to come in the mail!

- No more waiting in a line at any IRS office for paying the 2290 taxes!!

- No more travelling to any IRS office to get 2290 stamped!!!

All at one place, available at Tax2290.com or TaxExcise.com the #1 efile service provider since 2007.

Why do I need an Employer Identification Number (EIN) to e-file?

IRS need to have a system for protecting your privacy and making sure they know the identify of 2290 e-filers. IRS use a combination of your EIN and your name as a unique identifier for each taxpayer. On an e-filed return, if a taxpayer’s unique ID doesn’t match the IRS records, e-file rejects the return.

Make sure you enter the EIN and the Business Name / Name which you actually used while registering with the IRS, else IRS may reject your 2290 return for mismatch.

When are my Form 2290 taxes due?

When are my Form 2290 taxes due?

Normally, your due date depends on when you put your vehicles in service. In 2011 only, there is an exception for some taxpayers because IRS were not able to provide the Form 2290 until November 1, 2011.

For the Tax Year 2011, IRS tax Form 2290 is due Nov 30!

In 2011, if you were expected to file and pay by the last day of August, September or October you have an extension on your due date until November 30, 2011.

For other years, the annual taxable period begins on July 1 of the current year and ends on June 30 of the following year. For vehicles that are in use at the beginning of the tax period, your 2290 filing deadline is August 31. Taxes on the full tax period must be filed and paid in advance.

The due date for a partial period return depends on the month you first use your vehicle. If you place an additional taxable truck on the road during any month other than July, you are liable for 2290 taxes on it, but only for the months during which it was in service.

You must file Form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. You can find out when Forms 2290 are supposed to be filed in the table below, When Your Taxes Are Due.

These due date rules apply whether you are paying the tax or reporting the suspension of tax. It is important to file and pay all your 2290 taxes on time to avoid paying interest and penalties.

When Your Taxes Are Due

| IF, in this period, the vehicle is first used during |

Then, file Form 2290 and make your payment by*… |

|

| July | August 31** | |

| August | September 30** | |

| September | October 31** | |

| October | November 30 | |

| November | December 31 | |

| December | January 31 | |

| January | February 28 | |

| February | March 31 | |

| March | April 30 | |

| April | May 31 | |

| May | June 30 | |

| June | July 31 | |

| *File by this date regardless of when state registration for the vehicle is due | ||

| **NOTE: Taxpayers who were expected to file Form 2290 and pay by the last day of August, September or October have an extension on their due date until November 30, 2011. | ||

How will I know the IRS has received my return?

After IRS accept your return, you will receive an e-mail notification. You will also have access to an electronic version of the Schedule 1 containing a watermark of the e-file logo in the background. The Schedule 1 can be printed from your own computer. You may also subscribe for a TEXT Alert and for a FAX Copy of your IRS stamped Schedule 1.

How do I make corrections to my e-filed return?

How do I make corrections to my e-filed return?

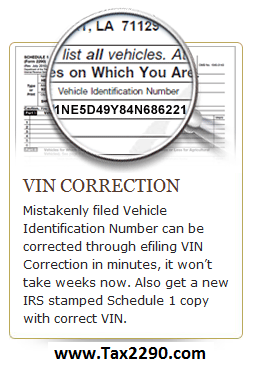

You can e-file a correction to VIN number typed in Schedule 1 copy[VIN correction], weight and/or mileage reported to IRS. You will need to make corrections by e-filing an 2290 amendment through Tax2290.com or TaxExcise.com and the corrected Schedule 1 copy will be available through Tax2290.com or TaxExcise.com in minutes.

If I buy another truck after I have e-filed my 2290 for the current tax period, should I e-file my original 2290 again and simply add the new vehicle to the Schedule 1?

No. If you e-file your 2290 and list the vehicles you own on the Schedule 1, then subsequently buy one or more additional trucks, you must file a new Form 2290 listing only the new vehicles. You may e-file that 2290 anytime before the last day of the month following the month the new vehicle was first used on public highways. Review the table above to find your due dates.

May I file one 2290 for two trucks that I place on the road in two consecutive months?

No. The amount of tax you owe depends on the month when you first placed your trucks on the road. In this case, you should file two Forms 2290, one for each vehicle and its partial tax period, and complete a Schedule 1 for each. Your tax will be more for the truck that was placed into service first. In the next tax year, you can file one 2290 for all the trucks you will have on the road for the 12 months of the tax year; that is, between July 1 of the current year and June 30 of the following year.

What should I do if my e-filed return is rejected by the IRS for duplication?

Make sure the correct Vehicle Identification Numbers are listed and are not duplications from a previous filing. Correct any duplication and re-submit the return.

If you are correcting VINs listed on a previously submitted and accepted return, you can now efile a return by marking as “VIN correction“. If the new VIN is totally different from what was listed on your original return (Schedule 1), you need to explain why the VIN you are now submitting is different.

When I submitted my Form 2290 electronically, I received an online duplicate filing error. Why did this happen?

When you submitted your return, the system detected that you had already filed a return under the same EIN, for the same tax period, for the same vehicle(s) and/or the same VIN category. Check your return to make sure you are reporting new vehicles only and that the other information you input is correct.

Can I claim a refund electronically for a vehicle that was sold, destroyed or stolen during the tax period?

Yes. You can claim a credit for the tax paid on the next Form 2290 you file in the same or subsequent tax period. Alternatively, a refund of the tax paid can be claimed on Form 8849, Schedule 6, Other Claims. The refund amount will depend on when the vehicle was sold, destroyed or stolen.

Can I claim a refund electronically for a vehicle I used less than 5,000 miles during the tax period?

Yes. If you already paid the tax on a vehicle you used for less than 5,000 miles, you can claim a credit on the first Form 2290 you file for thenext tax period. Alternatively, you can claim a refund of the tax paid on Form 8849, Schedule 6, Other Claims. However, a credit or claim for this refund cannot be filed until the next tax period.

A credit, lower tax, exemption or refund is not allowed for an occasional light or decreased load or a discontinued or changed use of a vehicle.

Call our Help Desk 1-866-245-391 or email all your queries to support@TaxExcise.com, we are very happy to support you through the filing.

Call our Help Desk 1-866-245-391 or email all your queries to support@TaxExcise.com, we are very happy to support you through the filing.

Starting July 1, 2010, many businesses offering tanning services must collect a 10 percent excise tax on the tanning services they provide. This excise tax requirement is part of the Affordable Care Act that was enacted in March 2010. Indoor Tanning tax has to be reported for the 1st Quarter of 2011 is due by May 2nd, 2011.

Starting July 1, 2010, many businesses offering tanning services must collect a 10 percent excise tax on the tanning services they provide. This excise tax requirement is part of the Affordable Care Act that was enacted in March 2010. Indoor Tanning tax has to be reported for the 1st Quarter of 2011 is due by May 2nd, 2011.