Electronic filing helps the Federal Vehicle Use Tax Form 2290 filers to report and pay the 2290 Truck Taxes faster, easier and more accurately than with traditional paper forms. We offer full featured online web based tax software, a self-serviced website to prepare the 2290 tax returns and pay electronically. The IRS encourages every truck taxpayer to choose electronic filing for the convenience and faster processing of tax returns, the IRS watermarked Schedule 1 Proof of Payment will be sent to them instantly once it is accepted. Correcting the errors on a rejected return is also easy, and the turn around time of processing is faster and the updated Schedule 1 is sent to the inbox directly. No delays, accurate tax math, on-time filing and filing at your comfort, no need to walk-in to a local IRS taxpayer assistance center booking appointments. Do it online from wherever you’re at anytime, 24X7 a day and 7 days a week.

Continue reading Electronic Filing is the Most Preferred Medium to Report and Pay 2290 HVUT Returns with the IRSTag Archives: Form 2290 online filing

TaxExcise.com User Friendly Features For Electronic Filing

TaxExcise.com is the product of Thinktrade Inc, the first IRS authorized E-file service provider serving the Federal Excise Tax filers since 2007. Partnering with thousands of excise taxpayers, truck taxpayers and tax accountants or paid preparers to ease the federal excise tax electronic filing process. With combined efforts of tax experts and technology, we have mastered the art of filing taxes and provided ideal solutions to everyone ranging from owner operators to fleet owners, truckers and CPAs.

With a wave of services and e-filing taxes for various forms, we top the ranking in serving you right from the time you entered our website, till you exit with your acknowledged receipt. TaxExcise.com bring you the comfort of electronic filing to your home/office computer, e-file federal excise tax returns anytime from anywhere. Market leader in Excise Tax segment and only website to support all the Federal Excise Tax Forms Electronic filing at one place. Download our free mobile apps to e-file on the go. Not only that the best is yet to come…

Continue reading TaxExcise.com User Friendly Features For Electronic FilingForm 2290 renewal time for the tax year July 2020 – June 2021.

During this unprecedented crisis, while families and employees are staying safe home, the trucking industry is there to ensure the most critical goods are delivered to U.S. communities. Truckers making it possible to deliver essentials across the country knowing that they are getting exposed. The nation’s 3 million truck drivers are unsung heroes of the coronavirus crisis, working overtime to keep the critical supply chain moving. We salute them for the Selfless Service and helping all the Front Liners equipped with essentials. Let this July be a new beginning for us to move forward from crisis to recovery.

This July we’re celebrating our independence and we wish every one a Happy 4th of July. It is also the time of the year, the federal vehicle use tax form 2290 for this new tax year July 2020 through June 2021 is up for renewal. The Form 2290 and Schedule 1 has to be reported and get it stamped to show that as a proof of payment to have the vehicles registered under your authority with the federal agencies.

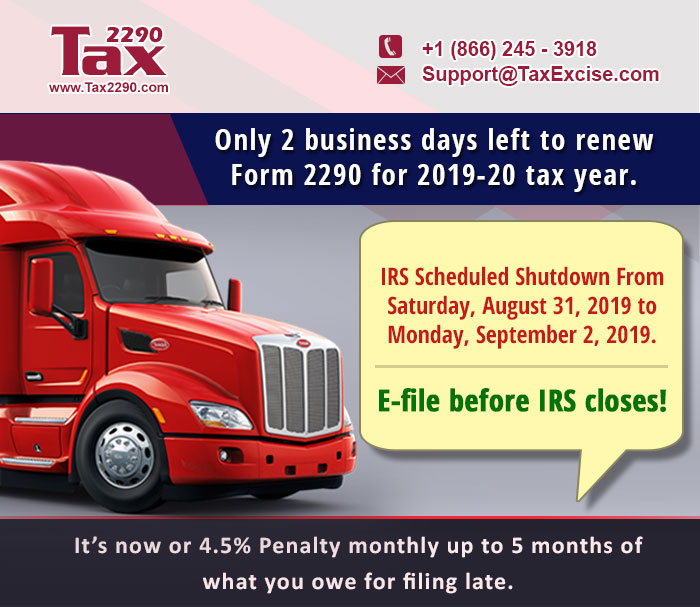

Continue reading Form 2290 renewal time for the tax year July 2020 – June 2021.LAST BUSINESS DAY IN AUGUST AND YOU STILL WAITING TO RENEW YOUR 2290 TAX RETURNS FOR TAX YEAR 2019-20

August and last minute filers are now very active to report and pay the Form 2290 Truck Tax returns with the IRS. If you still waiting and delaying it further, you just have one business day left and it is September 3, 2019 to get it done. Yes this year the Form 2290, reporting and paying the Federal Vehicle Use Tax returns is extended till September 3, officially.

We’re here and working on all the days till the official deadline September 3rd, to help out users with their 2290 efiling. Yes, you read it right we’re working on Labor Day and the long weekend to support our users with the 2290 efiling. Talk to us at 866 – 245 – 3918 or join us in LIVE Chat!

You’re reading this blog, then you have a pleasant surprise yes 50% off on your eFile fee to encourage you towards 2290 eFiling, well with in the due date. Apply code “PETER2290” to avail it. The code can get you pay just half the price to eFile 2290 returns and one last chance to save big on your preparation fee. Happy Trucking!

HEADING TOWARDS LAST COUPLE OF DAY TO RENEW FORM 2290 WITH THE IRS FOR THE TAX YEAR JULY 2019 TO JUNE 2020

We are heading towards the end of August and the official deadline for IRS Tax Form 2290 is extended till September 3, 2019 for this tax year as the usual due date August 31 falls on a Saturday. The next business day, September 2 is a Federal Holiday so the official deadline is September 3, 2019.

Today August 29th and you have just couple of days to get your Federal Vehicle Use Tax Form 2290 renewed and receive back the Watermarked Schedule 1 Proof of Payment for this current tax year.

IRS Tax Form 2290 and Watermarked Schedule 1 receipt.

This Form 2290 is an annual tax paid in advance with the IRS for all the heavy vehicles use on a public highway from July and that is to be registered on your name with the federal bodies such us DOT and DMV.