The IRS released a notice (Notice 2020-48) automatically extending the due date for excise tax returns reporting federal sporting goods excise taxes until Oct. 31, 2020 for returns that are generally due July 31. Further, the period from Aug. 1 through Oct. 31 will be disregarded for purposes of calculating any penalties or interest for the second quarter returns that are not paid by Oct. 31. The penalties and fees will begin to accrue on Nov. 1, 2020 if the taxes are not paid or the returns are not filed.

Tax is imposed on a manufacturer or importer’s sale of certain sport fishing equipment and bows and arrows. The tax is reported quarterly on a Form 720, Quarterly Federal Excise Tax Return, with the second quarter returns (covering April through June) due on July 31. Pursuant to an emergency declaration issued by the president and the authority granted to the Treasury under section 7508A, the Treasury may postpone the time for performing certain acts under internal revenue laws for taxpayers determined to be affected by a federally declared disaster. On March 13, 2020 the president issued such an emergency declaration.

Any taxpayer required to remit a federal sporting goods excise tax payment and file a return under the sport fishing and archery equipment numbers on Part II of Form 720, on July 31, 2020, has been designated as an affected taxpayer. Notice 202-48 provides additional compliance instructions that must be followed to meet the relief provided.

Washington National Tax observations

The extension of payment and filing for the sporting goods excise taxes will be welcome relief for manufacturers and importers of these products.

It is important to remember the following:

- This notice does not extend the payment and filing deadline for all excise taxes, only the federal sporting goods excise taxes. Thus, if taxpayers report other taxes during the second quarter, in addition to the sporting goods excise taxes, these other taxes must be reported by the July 31, 2020 deadline.

- This notice does not provide relief from the required semi-monthly deposits of excise taxes if the taxpayer’s liability is greater than $2,500 per quarter. Taxpayers must continue to make deposits even if they opt to take advantage of the delayed filing and payment relief.

Taxpayers who are unsure of their filing obligations or the deadlines for their excise tax liabilities should consult their tax advisor for clarification.

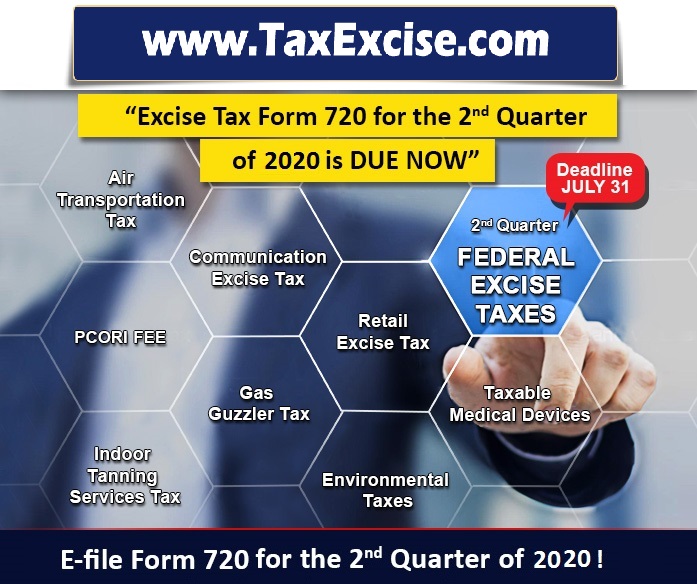

Choose Electronic Filing for Federal Quarterly Excise Tax Filing – Form 720. 2nd Quarter returns are due now and July 31 is the last date to file it with the IRS.

TaxExcise.com an IRS Authorized eFile provider can help you with your 720 efiling, it is easy and fast, you can handle your taxes by yourself!