Before we even realize it, the tax season is here. And all the taxpayers need to stay alert on their respective due dates to file their tax returns and pay the tax dues to the IRS within the deadline to avoid any last-minute mishaps. The IRS will charge late fees, penalties, and interests if you miss the deadline based on your total tax due amount. The interest will be 0.5% to 1% based on your category, and it can go up to 25% per month of the total tax amount. Even 25% interest is unnecessary because you have the option to file a tax extension with the IRS to save you from all these penalties and interests. But IRS doesn’t grant tax extension time to pay your tax due amount. You have to pay at least 90% percent of your total tax amount by the actual deadline. IRS only gives a six-month tax extension time to submit your entire tax reports for the year along with the supporting documents.

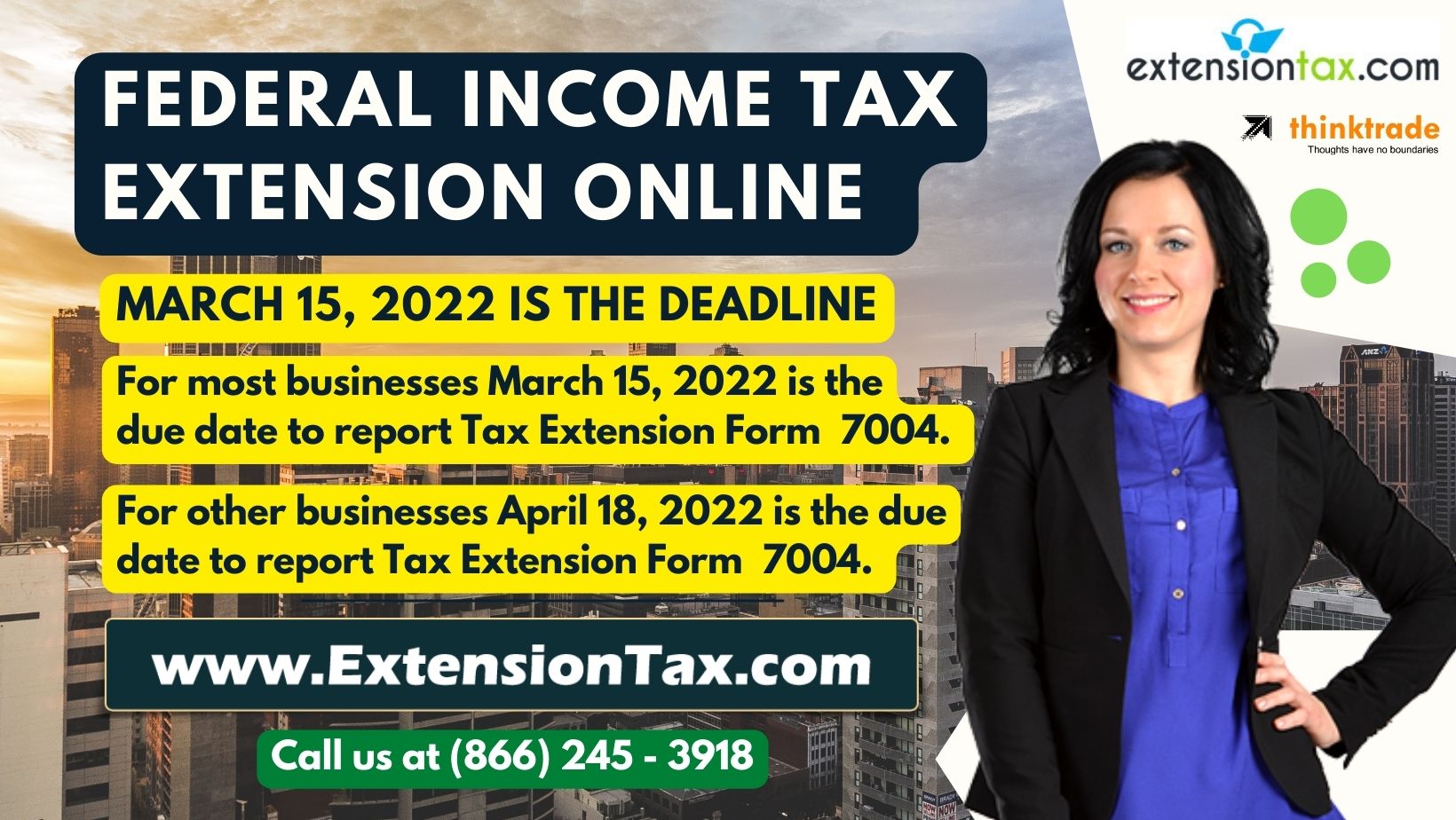

Extensiontax.com provides the best e-filing service for tax extension applications Form 7004, Form 4868, Form 8868, and Form 2350. We are an IRS authorized e-file service provider known for e-filing IRS tax extension forms for business and individual taxes. You can e-file all the above-mentioned tax extension forms to the IRS only at $14.99 per form in extensiontax.com.

|

Forms |

Purpose |

Deadline |

| Form 7004 | Business Income Tax Extension Form |

March 15th 2022 (S-Corps, LLCs, Partnerships) April 18th 2022 (Corporates) |

| Form 4868 | Individual Income Tax Extension Form |

April 18th 2022 |

| Form 8868 | Tax Exempt Organization Extension for filing returns |

May 16th 2022 |

| Form 2350 | Tax Extension for ‘out of the country’ scenarios |

April 18th 2022 |

We request the taxpayers to stay vigilant on the due dates and remember the deadlines to pay and submit the tax reports using the appropriate original tax forms. If you can’t submit your income tax reports on time, then you should estimate and pay the tax amount to the IRS and file for a tax extension to get the additional time to report your tax returns to the IRS.

Let us look into the reasons that you should file for a tax extension

Stay away from IRS audits

IRS takes strict actions on the people or businesses who are improper in their tax payments and reporting. They will scrutinize you to the maximum if you miss the deadlines on tax payment and filing the tax returns properly. So, it is wise for the taxpayers, CPAs, and tax preparers to file for a tax extension and take the automatic tax extension time offered by the IRS. You will get more time to get everything in order and submit the tax reports perfectly.

Eliminate Penalties and Interests

IRS would charge penalties and interests over your tax due amount if you missed out on the deadlines. Even if you paid the tax amount and failed to submit your tax returns, IRS will still charge penalties and late fees based on your tax dues. And somehow, your penalty will be going on up to 25% per month on your entire tax due amount. To avoid all these, you must file for an extension tax form based on your business income or individual income and take your time to prepare your income tax reports.

Extra Time

Generally, businesses need or take more time to get their accounting and other supporting documents in order to file tax reports to the IRS. And the whole purpose of the business income tax extension form is to grant an automatic six-month extra time to submit the tax reports. Also, IRS will not ask for any reason for tax extensions, either its business or individual. So, it would be best to have additional time to complete your tax returns and submit them to the IRS to avoid any future issues.

Waiting for any supporting documents

It is mandatory that you should attach every supporting document while filing your income tax returns to the IRS to avoid confusion during the IRS audits. You need to collect all the documents and necessary information properly and file your tax reports to the IRS. Usually, gathering all the supporting documents might get impossible on time, so it is wise to file for a tax extension form and get the automatic tax extension from the IRS. A tax extension is very much useful for businesses in this case. They can’t gather and assemble all the supporting documents and information before the deadline and file the complete income tax returns to the IRS. So, filing the business income tax extension form 7004 will be useful to get the automatic six-month tax extension from the IRS.

Out of Station

If you are on leave or vacation or even out of the country during the tax days, it would be best for you to apply for a tax extension to the IRS. You cannot compile your tax returns on time if you are out of the station, and you should file for an income tax extension using the appropriate form to get an automatic tax extension of a maximum of six months. Even though you had entrusted the entire tax reports preparation process to a paid preparer or CPA, you need to oversee everything and approve all the documents and information before filing the tax returns to the IRS. So, filing for an income tax extension when you are out of the station is best to stay away from confusion and mishaps in your tax reports.

The tax season is upon us and the deadlines are approaching soon. And it will be up on us before we realize. So, apply for tax extension now at extensiontax.com and get the automatic six-month extension from the IRS to submit your tax reports.