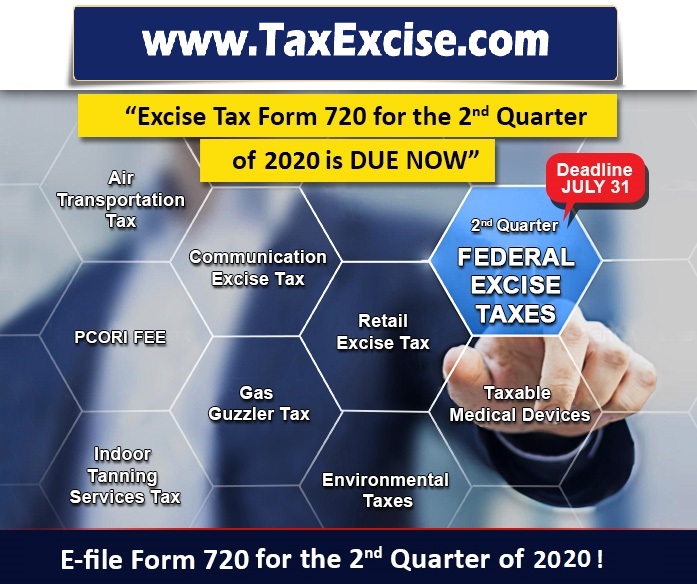

The IRS released a notice (Notice 2020-48) automatically extending the due date for excise tax returns reporting federal sporting goods excise taxes until Oct. 31, 2020 for returns that are generally due July 31. Further, the period from Aug. 1 through Oct. 31 will be disregarded for purposes of calculating any penalties or interest for the second quarter returns that are not paid by Oct. 31. The penalties and fees will begin to accrue on Nov. 1, 2020 if the taxes are not paid or the returns are not filed.

Continue reading Second quarter sporting goods excise tax filing deadline extendedTag Archives: Tax Excise Quarterly Returns online

Quarterly Federal Excise Tax Returns for 1st Quarter is Due this April 30

Federal Excise Taxes are taxes paid when purchases are made on a specific good, such as gasoline. This excise taxes are often included in the price of the product and collected from the buyer and paid at end of every quarter with the IRS. There are also excise taxes on activities, such as on wagering or on highway usage by trucks. One of the major components of the excise program is motor fuel, offering services like indoor tanning services, PCORI etc.

1st Quarter Federal Excise Tax Due on April 30

The first quarter federal excise taxes that a business has collected will consolidate it in the IRS Tax Form 720, and report it with the IRS by end of a quarter and pay, it is due this April 30.

Continue reading Quarterly Federal Excise Tax Returns for 1st Quarter is Due this April 30

Continue reading Quarterly Federal Excise Tax Returns for 1st Quarter is Due this April 30