Greetings! You have landed at the right place in case you have been wondering why everyone’s talking laurels about e-filing over paper for long now. Obviously, you go green immediately, without wasting paper products of our beloved little left trees. The ability to file your tax returns round the clock throughout the week right at your desk at home makes life very comfortable and easy. The speed of the entire tax return process dramatically increases with e-filing over paper due to advanced internet capabilities thus saving you money and energy worked out on postage/fax/courier/delivery charges, which of course can be used over a million other valuables. Continue reading Why e-file Form 2290 and not paper file?

Tag Archives: 2290 tax

Tax preparers take advantage of e-file options – IRS Recommends!

Taxpayer Assistance Centers Service Changes for 2012 Filing Season

Beginning this year, IRS Taxpayer Assistance Centers generally will not accept bulk returns for processing and mailing, particularly when it affects taxpayer services. The IRS hopes to eliminate the practice of taxpayer representatives dropping off completed returns for processing, especially during peak operating periods.

The intent of this policy change is not to limit assistance to taxpayers or their authorized representatives. Nor is it intended to limit taxpayer representatives’ visits to support their clients, particularly in situations where the taxpayer is facing financial harm or undue hardship, such as delinquent returns or to start or stop an installment agreement. It is designed, primarily, to stop the practice of dropping off returns solely for processing and mailing when the returns can be mailed directly to the IRS processing center. The TACs will accept returns with imminent statute implications, with remittances or other situations where it’s in the best interest of the taxpayer and the Service to accept them.

Local TAC managers have the authority to make exceptions to this policy and will accept drop off returns if, in their opinion, tax preparation and other customer account services are not impacted.

The IRS encourages all tax preparers to take advantage of available e-file options to file returns electronically to avoid the need to have returns accepted and mailed at the local Taxpayer Assistance Center. IRS has also mandated e-filing for taxpayers with 25 or more vehicles with registered gross weight of 55,000 lbs or more.

E-file with www.TaxExcise.com

With our tax return software, tax practitioners can e-file federal tax form 2290 for their Clients. We are an IRS Certified Authorized E-File Provider for federal form 2290. Using our Software gives you the option to e-file and transmits Form 2290 directly to the Internal Revenue Service(IRS). Our tax software has all of the features needed to complete Tax Form 2290 in a quick and accurate manner. We provide tax advice and tax support that you can count on and security that you can trust. Just register once and you can manage all your clients using the same tax return account.

TaxExcise.com FEATURES ALSO INCLUDES:

Stamped Schedule-1 in minutes.

Calculating accurate HVUT taxes (2290) for annual and partial year filings.

Retrieve and print IRS accepted Stamped Schedule 1 in minutes.

Access anytime, anywhere to your 2290 form stored under your profile.

Full E-file support for Form 2290 with Amendments, Form 8849 and Form 720.

E- File for VIN correction.

Safe and secure e-filing.

Bulk uploads.

Error check – We check your forms for errors even before the IRS does.

Live chat, Phone support and Email Support

SMS Alert.

Schedule one copy by fax.

Taxexcise.com is committed to provide the Best in Quality and Service for all our users, www.Tax2290.com / www.TaxExcise.com is a certified, IRS authorized, e-file service provider for Form 2290.Tax2290 is a product of ThinkTrade Inc and a part of TaxExcise.com. We are a BBB accredited company with A+ certification.

For any questions you may have regarding Excise Tax Filings please reach us at 1-866-245-3918 or simply write to us at support@taxexcise.com

FAQs for Truckers Who e-file IRS Form 2290

Who is required to file Form 2290 and pay Heavy Highway Vehicle Use Tax?

Anyone who registers a heavy highway vehicle in their name with a gross weight of 55,000 pounds or more must file Form 2290 and pay the tax. Typically, owners of vans, pickup trucks, panel trucks and similar trucks are not required to file Form 2290 or pay tax on these smaller trucks. Trucks that are used for 5,000 miles or less (7,500 for farm trucks) are also excluded from this tax.

Who is required to e-file Form 2290?

IRS encourage all 2290 filers to e-file. If you are reporting 25 or more heavy highway vehicles for any taxable period, you are required to e-file through an IRS-approved software provider Tax2290.com or TaxExcise.com. Electronic filing improves tax processing and saves you personal resources, including time and postage. In addition, e-file reduces preparation and processing errors. You can e-file your return from your own computer, any time of day or night. Use e-file and your IRS Stamped Schedule 1 is available through Tax2290.com or TaxExcise.com immediately after IRS accepts it.

- No more waiting for it to come in the mail!

- No more waiting in a line at any IRS office for paying the 2290 taxes!!

- No more travelling to any IRS office to get 2290 stamped!!!

All at one place, available at Tax2290.com or TaxExcise.com the #1 efile service provider since 2007.

Why do I need an Employer Identification Number (EIN) to e-file?

IRS need to have a system for protecting your privacy and making sure they know the identify of 2290 e-filers. IRS use a combination of your EIN and your name as a unique identifier for each taxpayer. On an e-filed return, if a taxpayer’s unique ID doesn’t match the IRS records, e-file rejects the return.

Make sure you enter the EIN and the Business Name / Name which you actually used while registering with the IRS, else IRS may reject your 2290 return for mismatch.

When are my Form 2290 taxes due?

When are my Form 2290 taxes due?

Normally, your due date depends on when you put your vehicles in service. In 2011 only, there is an exception for some taxpayers because IRS were not able to provide the Form 2290 until November 1, 2011.

For the Tax Year 2011, IRS tax Form 2290 is due Nov 30!

In 2011, if you were expected to file and pay by the last day of August, September or October you have an extension on your due date until November 30, 2011.

For other years, the annual taxable period begins on July 1 of the current year and ends on June 30 of the following year. For vehicles that are in use at the beginning of the tax period, your 2290 filing deadline is August 31. Taxes on the full tax period must be filed and paid in advance.

The due date for a partial period return depends on the month you first use your vehicle. If you place an additional taxable truck on the road during any month other than July, you are liable for 2290 taxes on it, but only for the months during which it was in service.

You must file Form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. You can find out when Forms 2290 are supposed to be filed in the table below, When Your Taxes Are Due.

These due date rules apply whether you are paying the tax or reporting the suspension of tax. It is important to file and pay all your 2290 taxes on time to avoid paying interest and penalties.

When Your Taxes Are Due

| IF, in this period, the vehicle is first used during |

Then, file Form 2290 and make your payment by*… |

|

| July | August 31** | |

| August | September 30** | |

| September | October 31** | |

| October | November 30 | |

| November | December 31 | |

| December | January 31 | |

| January | February 28 | |

| February | March 31 | |

| March | April 30 | |

| April | May 31 | |

| May | June 30 | |

| June | July 31 | |

| *File by this date regardless of when state registration for the vehicle is due | ||

| **NOTE: Taxpayers who were expected to file Form 2290 and pay by the last day of August, September or October have an extension on their due date until November 30, 2011. | ||

How will I know the IRS has received my return?

After IRS accept your return, you will receive an e-mail notification. You will also have access to an electronic version of the Schedule 1 containing a watermark of the e-file logo in the background. The Schedule 1 can be printed from your own computer. You may also subscribe for a TEXT Alert and for a FAX Copy of your IRS stamped Schedule 1.

How do I make corrections to my e-filed return?

How do I make corrections to my e-filed return?

You can e-file a correction to VIN number typed in Schedule 1 copy[VIN correction], weight and/or mileage reported to IRS. You will need to make corrections by e-filing an 2290 amendment through Tax2290.com or TaxExcise.com and the corrected Schedule 1 copy will be available through Tax2290.com or TaxExcise.com in minutes.

If I buy another truck after I have e-filed my 2290 for the current tax period, should I e-file my original 2290 again and simply add the new vehicle to the Schedule 1?

No. If you e-file your 2290 and list the vehicles you own on the Schedule 1, then subsequently buy one or more additional trucks, you must file a new Form 2290 listing only the new vehicles. You may e-file that 2290 anytime before the last day of the month following the month the new vehicle was first used on public highways. Review the table above to find your due dates.

May I file one 2290 for two trucks that I place on the road in two consecutive months?

No. The amount of tax you owe depends on the month when you first placed your trucks on the road. In this case, you should file two Forms 2290, one for each vehicle and its partial tax period, and complete a Schedule 1 for each. Your tax will be more for the truck that was placed into service first. In the next tax year, you can file one 2290 for all the trucks you will have on the road for the 12 months of the tax year; that is, between July 1 of the current year and June 30 of the following year.

What should I do if my e-filed return is rejected by the IRS for duplication?

Make sure the correct Vehicle Identification Numbers are listed and are not duplications from a previous filing. Correct any duplication and re-submit the return.

If you are correcting VINs listed on a previously submitted and accepted return, you can now efile a return by marking as “VIN correction“. If the new VIN is totally different from what was listed on your original return (Schedule 1), you need to explain why the VIN you are now submitting is different.

When I submitted my Form 2290 electronically, I received an online duplicate filing error. Why did this happen?

When you submitted your return, the system detected that you had already filed a return under the same EIN, for the same tax period, for the same vehicle(s) and/or the same VIN category. Check your return to make sure you are reporting new vehicles only and that the other information you input is correct.

Can I claim a refund electronically for a vehicle that was sold, destroyed or stolen during the tax period?

Yes. You can claim a credit for the tax paid on the next Form 2290 you file in the same or subsequent tax period. Alternatively, a refund of the tax paid can be claimed on Form 8849, Schedule 6, Other Claims. The refund amount will depend on when the vehicle was sold, destroyed or stolen.

Can I claim a refund electronically for a vehicle I used less than 5,000 miles during the tax period?

Yes. If you already paid the tax on a vehicle you used for less than 5,000 miles, you can claim a credit on the first Form 2290 you file for thenext tax period. Alternatively, you can claim a refund of the tax paid on Form 8849, Schedule 6, Other Claims. However, a credit or claim for this refund cannot be filed until the next tax period.

A credit, lower tax, exemption or refund is not allowed for an occasional light or decreased load or a discontinued or changed use of a vehicle.

Call our Help Desk 1-866-245-391 or email all your queries to support@TaxExcise.com, we are very happy to support you through the filing.

Call our Help Desk 1-866-245-391 or email all your queries to support@TaxExcise.com, we are very happy to support you through the filing.

IRS Form 2290 Amendment efiling

When reporting an original Form 2290, Heavy Motor Truck Tax with IRS for the tax year, you would have changed some information like VIN, Gross Weight, Mileage Limit then IRS wants you to file amendments to the originally filed form 2290. There are three types of amendments available for form 2290

- Suspended/Exempt Vehicles exceeding the mileage use limit

- Additional Tax From Increase in Taxable Gross Weight

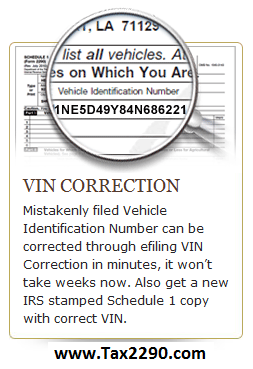

- VIN Correction

For a vehicle that will be used within 5,000 miles or less (7,500 miles or less for agricultural vehicles) during the period, it can be reported as a suspended/exempt vehicle from tax liability.

Suspended/Exempt Vehicles exceeding the mileage use limit:

Once a suspended vehicle exceeds the mileage use limit, the tax becomes due. Mileage use limit means the use of a vehicle on public highways 5,000 miles or less (7,500 miles or less for agricultural vehicles). The mileage use limit applies to the total mileage a vehicle is used during a complete tax period, regardless of the number of owners.

We will figure the tax based on the month the vehicle was first used in the period. The tax due has to be paid to the IRS by available Payment Options. By e-filing the amended Form 2290, by the last day of the month following the month in which the mileage use limit was exceeded.

A corrected schedule-1 copy with the VIN and other details will be stamped by IRS and the same will be sent to you by email. You have the option of printing the corrected Schedule-1 copy by logging into your personal account. You also have the option to subscribe for a copy by FAX.

Additional Tax from Increase in taxable gross weight:

The taxable gross weight of a vehicle increases during the period and the vehicle falls in a new category then you are suppose to report an 2290 Amendment and pay the tax due on time.

For instance, an increase in maximum load customarily carried may change the taxable gross weight.

Report the additional tax for the remainder of the period on Form 2290, e-file Form 2290 and Schedule 1 by the last day of the month following the month in which the taxable gross weight increased.

Figure the additional tax using the following:

1. Identify the month the taxable gross weight increased.

2. Determine the new taxable gross weight category.

If the increase in taxable gross weight occurs in July after you have filed your return, you still have to report a new amendment form for the additional tax.

A corrected schedule-1 copy with the VIN and new category [Gross Weight] will be stamped by IRS and the same will be sent to you by email. You have the option of printing the corrected Schedule-1 copy by logging into your personal account. You also have the option to subscribe for a copy by FAX.

VIN Correction:

If you are correcting a vehicle identification number (VIN) listed on a previously filed Schedule 1 (Form 2290). While reporting a Form 2290 for your vehicle, by mistake if you have filed for a wrong Vehicle Identification Number [VIN] then you have to file a new amendment for VIN correction.

A corrected schedule-1 copy with the correct VIN and other details will be stamped by IRS and the same will be sent to you by email. You have the option of printing the corrected Schedule-1 copy by logging into your personal account. You also have the option to subscribe for a copy by FAX.

Call our Support Center [HELP DESK] at 1-866-245-3918 for any queries or write to us at support@taxexcise.com, At taxexcise.com we are always happy to help you through your filing process.

Report Excise Tax Forms [2290, 8849 & 720] onlinw at TaxExcise.com

Excise Tax e-File & Compliance (ETEC) Programs – Form 720, Form 2290 and Form 8849

Excise Tax e-File & Compliance (ETEC) Programs – Form 720, Form 2290 and Form 8849

The Excise Tax e-File project was initiated to satisfy the IRS’ requirement to provide electronic filing of Form 2290, Heavy Highway Vehicle Use Tax Return, as directed in the American Jobs Creation Act (October 2004). Excise Tax e-File & Compliance (ETEC) Programs (Form 720, 2290 and 8849) has joined the ever-growing-number of tax forms and schedules that can be electronically filed, providing taxpayers the speed and reliability that millions of taxpayers and business owners already enjoy. www.TaxExcise.com offers simple, easy and quick website to file all these excise tax form electronically with IRS. Efile, It’s as easy as 1-2-3!!!

Form 720, Quarterly Federal Excise Tax Return is available for optional electronic filing at www.TaxExcise.com. Simply opt to do your taxes online and join millions of taxpayers enjoying the convenience and ease of on-line filing, immediate acknowledgement of receipt and faster service. Basic interview questions to complete your tax return.

Form 2290, Heavy Highway Vehicle Use Tax Return is available for electronic filing at www.TaxExcise.com. The electronic version of Form 2290 will improve excise tax processing, expedite refunds, save personal resources (e.g., time & postage) and reduce preparation and processing errors. Schedule 1 will be available almost immediately (once your return is accepted by the IRS) through www.taxexcise.com – no more waiting for it to come in the mail!

By doing your Truck Tax reporting online [e-filing] you enjoy the maximum comfort:

- IRS Stamped Schedule 1 copy in minutes

- TEXT Alert on status of your return.

- Receive Schedule 1 copy by FAX

- E-file 2290 Amendments, VIN correction, Sold / Transfer Vehicle Credits.

- Bulk data upload, also retrieve prior year data by importing

- No Complex math, Easy to do service.

- No Transaction Charges or Hidden Charges. You pay what you See!!!

- Rated #1 by tax payers; more than 55,000 tax payers have e-filed in 2010.

- No more waiting for Schedule 1 copy by mail; get your copy in minutes through Email and FAX.

- No need to wait in long Queue at IRS office, do it online from anywhere at any time. Opens 24/7, 7 days a week.

- Quick, Safe, Simple, Easy and Most Secured network to file your secured tax returns with IRS.

Electronic filing:

Taxpayers filing Form 2290 reporting 25 or more vehicles for any taxable period are required by statute to electronically file their Form 2290 tax return through an IRS at www.Tax2290.com an approved & authorized software provider.

Form 8849, Claim for Refund of Excise Taxes (Schedules 1,2, 3, 5, 6 and 8) are now available for optional e-file. Electronically submitted Schedules 2, 3 and 8 refund claims will be processed within 20 days of acceptance by the IRS, versus the usual 45 day processing time on all other 8849 schedules.

FILE YOUR TAXES NOW!

To file your excise forms electronically you will need to visit www.TaxExcise.com an IRS approved & authorized software provider for the tax forms you want to file. Form 720 filing information can be found on the www.tax720.com web page. Form 2290 filing information can be found on the 2290 web page www.Tax2290.com. Form 8849 filing information can be found on the 8849 web page www.Tax8849.com.

QUESTIONS? Call the Support Center Hotline at 866-245-3918 or simply write to support@taxexcise.com

Read Excise Tax: FAQ’s

Form 720 – Frequently Asked Questions

Form 2290 – Frequently Asked Questions

Form 8849 -Frequently Asked Questions